<p><br> <span class="small">December 05, 2023</span></p>

Unlocking sustainability value for all, at speed and scale

<p><b>Business leaders increasingly link sustainability investments with financial rewards, according to our research. But more is needed, and the right data and technology are vital.</b></p>

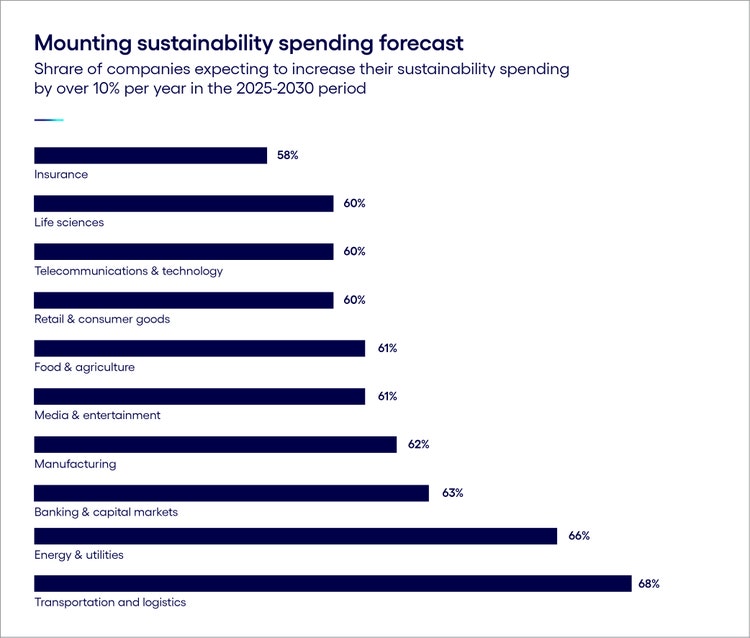

<p>Any conversation about society, the environment, climate change and the economy must start from two well-established premises.</p> <p>First, investing to avoid the worst effects of climate change <a href="https://www.bloomberg.com/opinion/articles/2023-11-13/climate-change-266-trillion-to-fight-global-warming-is-a-no-brainer?accessToken=eyJhbGciOiJIUzI1NiIsInR5cCI6IkpXVCJ9.eyJzb3VyY2UiOiJTdWJzY3JpYmVyR2lmdGVkQXJ0aWNsZSIsImlhdCI6MTY5OTg4MDE1NSwiZXhwIjoxNzAwNDg0OTU1LCJhcnRpY2xlSWQiOiJTNDI5QzVEV1JHRzAwMSIsImJjb25uZWN0SWQiOiIxMkE1QzVFRUNERDg0NUJEQjVFOTM1MUE0Mzk4QTAxNCJ9.-zllSTd8ksSP\_ytMYGgp7EyDjW9iwUPxLxMSVxUfzlI" target="_blank">is far cheaper</a> than allowing them to materialize. We’ve known this since at least 2006, when British economist Nicholas Stern published his landmark <a href="https://www.lse.ac.uk/granthaminstitute/publication/the-economics-of-climate-change-the-stern-review/#:\~:text=The%20Economics%20of%20Climate%20Change%3A%20The%20Stern%20Review%20has%20become,2007%20by%20Cambridge%20University%20Press." target="_blank">review</a>. Comparable findings around biodiversity loss were published in Pavan Sukhdev’s seminal <a href="https://dlc.dlib.indiana.edu/dlc/bitstream/handle/10535/8370/Putting%20a%20Price%20on%20Nature\_%20The%20Economics%20of%20Ecosystems%20and%20Biodiversity.pdf?sequence=1\&isAllowed=y" target="_blank">The Economics of Ecosystems and Biodiversity</a> 2011 study.</p> <p>Second, despite intense attention, growing concern, ever more universally visible evidence and some recent good news—such as the new <a href="https://iea.blob.core.windows.net/assets/13dab083-08c3-4dfd-a887-42a3ebe533bc/NetZeroRoadmap\_AGlobalPathwaytoKeepthe1.5CGoalinReach-2023Update.pdf" target="_blank">projection</a> by the International Energy Agency (IEA) that fossil fuel demand will peak this decade—we are still losing the race against catastrophic climate change.</p> <p>A simple and sobering data point for us all (regardless of where we sit in the anthropogenic debate) is that the potent combination of climate change and El Niño, a recurrent weather pattern, has made it “virtually certain” that 2023 will be the <a href="https://www.reuters.com/business/environment/this-year-virtually-certain-be-warmest-125000-years-eu-scientists-say-2023-11-08/" target="_blank">warmest of the last 125,000 years</a>.</p> <p>We’re not just <i>approaching</i> highly dangerous tipping points—such as the melting of the West Antarctic ice sheet— much more quickly than expected; at least some of these future impacts are likely already locked in. For example, <a href="https://www.nature.com/articles/s41558-023-01818-x" target="_blank">scientists believe</a> we can no longer avoid additional melting of that ice sheet throughout the 21<sup>st</sup> century even if we manage to drastically cut emissions. This will create different knock-on effects, from rising sea levels to lower planetary capacity to reflect solar radiation back into our atmosphere.</p> <p>Clearly, we need to reach further and move much faster. To borrow from the title of a book written by US venture capitalist John Doerr, “Speed & Scale” really is the name of the game.</p> <h4>The view from the corporate world</h4> <p>What does this mean for leaders at all levels of business?</p> <p>Climate change has always been a “tragedy of the commons” problem of global proportions. Individual companies whose activities and supply chains result in emissions—and which pay little or no price for them—follow their self-interest through those emissions and other forms of pollution. But when all are driven by self-interest, all become poorer.</p> <p>Recently, though, a mix of policy, improved technology, public awareness and pressure has started to change the decision dynamics for business leaders. Further, a growing number of companies have come to define addressing climate change and other environmental challenges in terms of more enlightened self-interest. This is partly driven by the realization that the scale, complexity and cost of these challenges require more and better collaboration.</p> <p>Enlightened, future-fit leaders understand that profitable and enduring businesses with a legitimate license to operate must have social and environmental practices and values not just at their core but also throughout their value chains. Such practices and values thus need to be supported by supply chain partners prepared, able and motivated to play their part.</p> <p>In our recent <a href="https://www.cognizant.com/us/en/publications/deep-green-report-on-business-sustainability/" target="_blank">survey</a> of 3,000 senior executives at businesses throughout the world and across industries, 68% said sustainability is now an important or very important part of their business strategy. As a result, 50% expect to increase sustainability budgets by over 10% year-on-year in the 2022-2025 period. For the 2025-2030 timeframe, this rises to 63% (see Figure 1). Why? Because two-thirds of businesses expect this investment to deliver positive or very positive financial outcomes.</p>

#

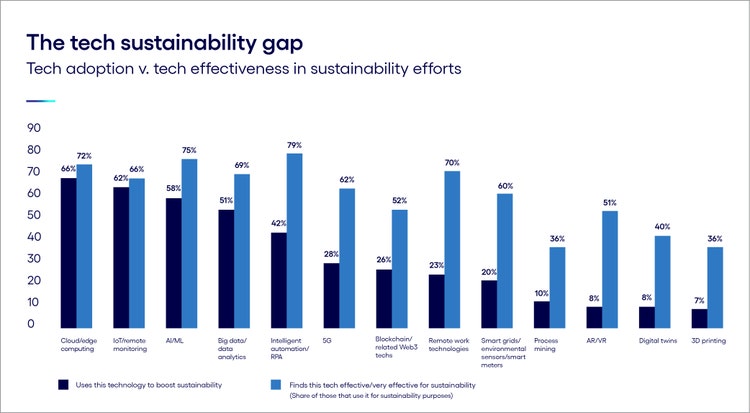

<p><span class="small">Base: 295 senior executives per industry<br> Source: Cognizant Research and Oxford Economics<br> Figure 1</span></p> <p>All this highlights a deeply encouraging level of awareness not just of climate change as an issue but also of its defining role in the wider business environment. But, again, we must move further and faster. Awareness is one thing; action, quite another—and here businesses are <a href="https://cdn.cdp.net/cdp-production/cms/reports/documents/000/006/785/original/Climate\_transition\_plan\_report\_2022\_%2810%29.pdf?1676456406" target="_blank">falling well short</a> of what is needed.</p> <h4>Five levers of change</h4> <p>In our view, the road to net zero has five lanes: policy, capital, corporate strategy, public engagement and technology.</p> <p>Policy sets and, through regulation, polices the rules of the game, ensuring the conditions to mobilize capital and business. With policy stability, capital follows and unlocks opportunities. These arise when businesses make pledges and take concrete steps toward net zero.</p> <p>This highlights the role and interests of corporate strategy and the need for careful alignment between it and sustainability strategy, organizational KPIs, the design and incentivization of teams, the development of sustainable products and services, and any ESG-related criteria of borrowing and investment.</p> <p>But, to bear fruit, good strategy must be underpinned by not just competent execution but also by the right data and the right technology.</p> <h4>Using tech to move forward</h4> <p>At Cognizant, we have the opportunity to closely follow how leading businesses are using technology to both mitigate climate change and adapt to it, and we’re privileged to initiate and participate in many of these efforts.</p> <p>A case in point is our <a href="https://www.cognizant.com/no/en/ocean" target="_blank">Cognizant Oceans</a> initiative, which is helping companies and industries associated with the blue economy use technologies such as artificial intelligence (AI) and advanced analytics improve business and sustainability outcomes.</p> <p>We’ve partnered with Tidal, a project from the Alphabet “moonshot factory,” to create a range of solutions that improve visibility and decision making in, for example, aquaculture companies and their supply chains. The goal is to enhance their sustainability, environmental resilience and bottom line. This is possible thanks to Tidal’s AI, trained on 900 terabytes of video with 8 billion observations.</p> <p>With our feet very much on land, we recently completed a study for a global distribution and retail business to determine how a sensor strategy might enable material cost and carbon reduction. Not only were we able to develop a roadmap for the business to remove 12% of its emissions and reduce its annual power and heating bill by 20%, but we were also so confident in that roadmap that we were prepared to underwrite the cost of delivering the strategy in a commercially creative risk-reward model.</p> <p>We’re working with companies from various energy-intensive industries on the use of data, cloud and AI to produce more accurate and useful <a href="https://www.cognizant.com/nl/en/insights/blog/articles/green-washing-and-regulatory-reporting" target="_blank">ESG reports</a>. Sustainability reporting remains fraught with challenges. Data gathering is still often highly labor-intensive and, as a result, often error-prone. Businesses and their value chains remain <i>littered</i> with data in various forms and from various sources. Data management approaches can vary from site to site and business unit to business unit, leading to data inconsistency.</p> <p>Moreover, systems are often structured for retrospective, not near/real-time, measurement that can drive superior operational decision making. Often, businesses have no common platform to aggregate, interrogate and easily detect errors or anomalies and make better use of data. The list of shortcomings goes on. The good news is that a well-tailored and effectively deployed ESG data strategy can quickly overcome them.</p> <p>There is far more to be done. In fact, our recent survey revealed that often the technologies least used in sustainability efforts are precisely the ones considered the most effective by those that do adopt them (see Figure 2).</p>

#

<p><span class="small">Base: 3,000 senior executives<br> Source: Cognizant Research and Oxford Economics<br> Figure 2</span></p> <h4>Twinning the digital and sustainability transformations</h4> <p>These examples, and many others from companies across industries, confirm the urgency of ”twinning” the digital and green transitions, as the <a href="https://commission.europa.eu/strategy-and-policy/strategic-planning/strategic-foresight/2022-strategic-foresight-report\_en" target="_blank" rel="noopener noreferrer">European Commission</a> recently put it. Our survey found that over 60% see a direct and positive link between their digital and sustainability strategies. To be sure, there will be costs in the short term, but businesses and the economy as a whole will benefit in the medium and long term.</p> <p>And we should never lose sight of the ultimate truth: When the planetary systems on which our communities depend are under threat, we each bear responsibility for the solutions and, given the urgency and scale of the challenge, must use proven mechanisms and technologies to fix them.</p> <p><i>For more, read our report “<a href="https://www.cognizant.com/us/en/insights/insights-blog/sustainability-in-business-beyond-green-to-deeply-green-wf1518050" target="_blank">Deep Green: how data, technology and collaboration will drive the next phase of sustainability in business</a>,” visit the </i><a href="https://www.cognizant.com/us/en/insights/sustainability-resilience" target="_blank" rel="noopener noreferrer"><b><i>Sustainability & Resilience</i></b></a><i> section of our website or </i><a href="https://www.cognizant.com/us/en/about-cognizant/contact-us" target="_blank" rel="noopener noreferrer"><b><i>contact us</i></b></a><i>.</i></p>

<p>Philip Smith has spent over 20 years supporting clients in multiple vertical and geographic markets and addressing their sustainability challenges through the lenses of policy, regulation, strategy, technology and organizational change.</p> <p><a href="mailto:Philip.Smith@cognizant.com">Philip.Smith@cognizant.com</a></p>

<p>Eduardo Plastino leads Cognizant's research on sustainability and how different industries can effectively navigate the complexities of the digital and green transformations.</p> <p><a href="mailto:Eduardo.Plastino@cognizant.com" target="_blank" rel="noopener noreferrer">Eduardo.Plastino@cognizant.com</a></p>