The AI advantage: why ANZ is positioned for gen AI success

<p><br> <span class="small">September 25, 2024</span></p>

The AI advantage: why ANZ is positioned for gen AI success

<p><b>Our recent study reveals the key factors inhibiting or accelerating business adoption of generative AI in Australia and New Zealand—and how ANZ businesses can ensure gen AI success.</b> <i></i></p>

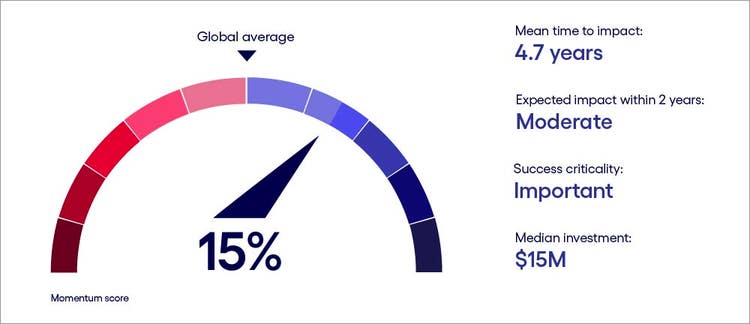

<p>Businesses in Australia and New Zealand (ANZ) believe generative AI is critical to their future success. Buoyed by their conviction, businesses in the region report a median planned spend of $15 million, higher than the global average at $12.5 million.</p> <p>However, a clear majority (69%) believe they aren't moving fast enough with their generative AI strategies, and over half (52%) believe these delays will result in a competitive disadvantage.</p> <p>At the same time, the ANZ region seems to offer an advantageous landscape for generative AI adoption relative to many other countries. The fact is, regional variances—regulatory environment, country infrastructure and available talent, for instance—as well as internal factors like the business’s own technology foundation, will influence success with implementing generative AI strategies and how businesses use this powerful technology. As a result, the pace of generative AI uptake and the way in which it’s used will be uneven across the globe.</p> <p>To better understand what generative AI adoption will look like globally, we conducted a study of 2,200 business leaders in 23 countries and 15 industries, including 200 in ANZ. The study assessed a wide range of generative AI adoption trends, including investment levels, use cases, how critical gen AI strategies are to business success and organizational readiness to adopt the technology.</p> <p>We also analyzed 18 regional and internal business factors that will either inhibit or accelerate business adoption of gen AI (see end of article for the full list of factors). Respondents evaluated each factor’s potential impact on their generative AI strategy, rating it as either positive or negative on a scale of high to low impact.</p> <p>From the results, we calculated a “momentum score” for each country or region. The momentum score represents the level of confidence business leaders have about being able to roll out their generative AI strategy based on internal business factors and the prevailing local conditions of their country or region.</p> <p>For all the regions covered, inhibitors to adoption outranked accelerators, meaning that all momentum scores skewed negative. In effect, businesses globally feel constrained by their operating environment.</p> <p>But to understand how different regions varied relative to each other, we averaged the ratings to establish a baseline global momentum score. This approach enabled us to identify regions that are more optimistic about their ability to adopt the technology compared with a global average.</p> <p>For Australia and New Zealand, the momentum score is 15% higher than the global average. The factors contributing to this score vary, but the most impactful are respondents’ more optimistic views than their global peers when it comes to their data readiness and operating model flexibility. Momentum is equally driven by a relatively less pessimistic view of their existing technology infrastructure and the cost and availability of capital, although ANZ businesses still rate both factors as significant inhibitors. Pulling the score back, ANZ leaders are more acutely concerned about generative AI’s impact on sustainability and have above-average concerns about current and prospective employee perceptions.</p> <p><b>ANZ gen AI scorecard</b></p>

#

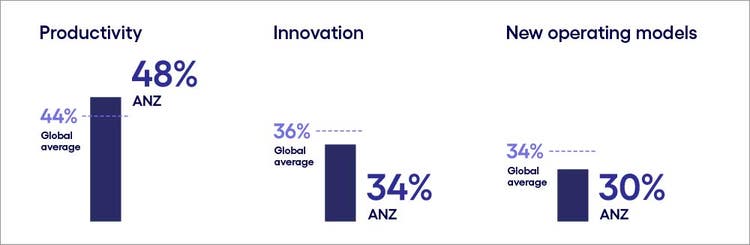

<p><span class="small">Base: 200 senior business leaders in ANZ<br> Source: Cognizant and Oxford Economics<br> Figure 1</span></p> <p>As for where their generative AI investments will be aimed in the near term, we looked at two distinct uses of the technology: productivity, such as helping people work more quickly and get more done, and disrupt-the-business innovations, which involves more sweeping change to business and operating models. Overall, ANZ mirrors the global trend: Over the next two years, more respondents emphasized productivity as their greatest strategic priority (see Figure 2).</p> <p><b>Greater focus on productivity than innovation</b></p> <p><i>Q: Which of the following best describes the role generative AI will play in your organization's business strategy in the next two years? (Percent of respondents naming each as a top-3 choice)</i></p>

#

<p><span class="small">Base: 200 senior business leaders in ANZ<br> Source: Cognizant and Oxford Economics<br> Figure 2</span></p> <p>However, our study also reveals a change in what productivity means when pursued with generative AI. The end goal is not efficiency and cost-cutting as has been the case with previous automation endeavors. This new dynamic requires fresh thinking around understanding business use cases of generative AI, which we’ll address later in this report.</p> <p>This report identifies the regional and business factors that could either inhibit or accelerate generative AI momentum in the ANZ region. It also provides an industry-specific look at how generative AI will be used, a regional focus on business readiness and strategies to successfully implement generative AI in ANZ.</p>

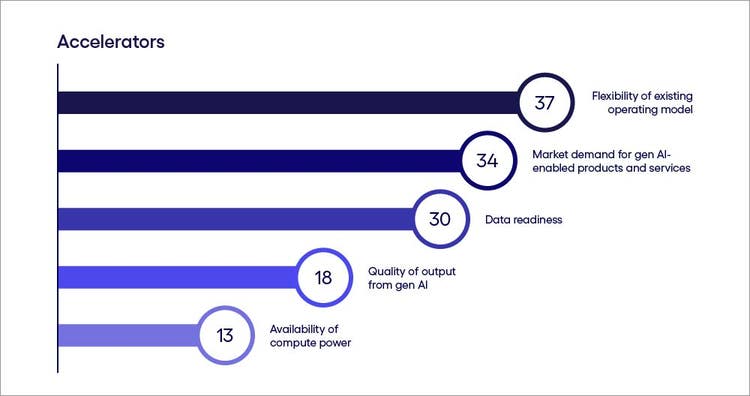

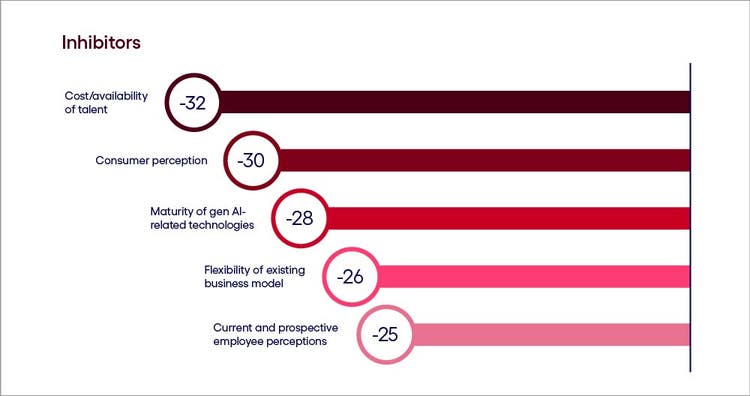

<h4>Inhibitors and accelerators: The forces driving AI momentum</h4> <p>To dig deeper into these mechanics, rather than comparing to a global average, we’ll now examine how business leaders rate inhibitors and accelerators within their region. By doing so, our study provides a detailed temperature check that leaders can use to take advantage of what’s working well in their local environment, while strategizing on overcoming challenges.</p> <p><b>A look at ANZ gen AI accelerators</b></p>

#

<p><span class="small">Respondents were asked which factors inhibit or accelerate their organization's adoption of generative AI. Score represents a percentage point difference to the country's momentum score compared to the global baseline.</span></p> <p><span class="small">Base: 200 senior business leaders in ANZ<br> Source: Cognizant and Oxford Economics<br> Figure 3</span></p> <p>A key driver for adoption in the region is the market demand for generative AI. Businesses in the region recognize that the market has spoken, making it essential to embed the technology into their operations or product and service offerings.</p> <p>Leaders in the region also have a rosy view about the flexibility of their operating model—believing they can adapt their processes to make the most out of generative AI. They are also optimistic about the readiness of their data to power the technology, naming this as the third highest accelerator for adoption. At the same time, they seem far less sure about the readiness of their overall technological infrastructure. A scant 9% cited their technological infrastructure as a gen AI accelerator.</p> <p>In effect, businesses recognize they have huge swathes of valuable data dotted around their business but are less sure about their technological capabilities to enable generative AI to use it. Digging deeper into the data, we can see the nuances of this challenge laid bare. Leaders are more likely to rate the quality and cleanliness of their data as either good or excellent (52% of respondents sit in this category). However, only 16% of respondents have a similarly positive view of the accessibility of their data. The risk is that any momentum gained through high data readiness will be stalled by challenges with legacy technology.</p> <p>The perceived output quality of existing generative AI solutions is another adoption accelerator for ANZ businesses. In many ways, ChatGPT captured the imaginations of businesses and individuals alike by the speed and quality of response to various prompts—albeit with a rocky start and multiple high-profile gaffs. But as this output has improved over the last year, business enthusiasm for generative AI has increased too.</p> <p>This confidence in the quality of generative AI output plays out in the wide range of business cases ANZ respondents highlighted in our survey. Nearly, one-third have fully deployed a generative AI solution for customer-facing communications. And 29% already use it to write or test software code.</p> <p><b>Understanding ANZ’s gen AI inhibitors</b></p>

#

<p><span class="small">Respondents were asked which factors inhibit or accelerate their organization's adoption of generative AI. Score represents a percentage point difference to the country's momentum score compared to the global baseline.</span></p> <p><span class="small">Base: 200 senior business leaders in ANZ<br> Source: Cognizant and Oxford Economics<br> Figure 4</span></p> <p>Chief among the factors inhibiting adoption, meanwhile, is the cost and availability of talent.<a><b> </b></a>Talent shortages continue to be challenging for the area; according <a href="https://www.jobsandskills.gov.au/publications/towards-national-jobs-and-skills-roadmap-summary/current-skills-shortages#:\~:text=About%2048%25%20of%20the%20occupations,and%20knowledge%2C%20qualifications%20and%20experience." target="_blank" rel="noopener noreferrer">to the Australian Government's analysis of current skills shortages</a>, 36% of occupations assessed were in national shortage, an increase of 5% since 2022.</p> <p>To overcome the talent crunch, over half (54%) of ANZ respondents plan to implement training programs to upskill employees. One-third, however, are looking to hire specialized generative AI talent—difficult to do amid talent scarcity.</p> <p>Consumer perception is another top inhibitor to gen AI adoption. A major source of consumer concern is the potential for job losses due to gen AI. However, an extremely small number of ANZ businesses believe they will need to lay off employees because of generative AI—only 3% of respondents said this was a real possibility.</p> <p>Instead, many ANZ businesses plan to help affected employees shift into roles in other areas of the business (46%) or provide training to upskill and boost productivity (34%). Businesses in the region need to do a better job of communicating their intended use of generative AI and how that will impact employees and the labor market.</p> <p>Another area of consumer concern has to do with potential crises fueled by AI. In <a href="https://theconversation.com/80-of-australians-think-ai-risk-is-a-global-priority-the-government-needs-to-step-up-225175" target="_blank" rel="noopener noreferrer">a recent survey by The Conversation</a>, 80% of Australians believe preventing catastrophic risks from advanced AI systems should be a global priority on par with pandemics and nuclear war.</p> <p>To this end, the Australian Government is working to drive responsible adoption of AI. In early 2023, it commissioned a report to assess the opportunities and risks of generative AI models, followed by the release of a public discussion paper, “Safe and Responsible AI In Australia”, which invited submissions and feedback from businesses and the community.</p> <p>The <a href="https://international.austrade.gov.au/en/news-and-analysis/news/australian-budget-commits-to-powering-net-zero-industries-and-th#:\~:text=The%20Australian%20Government%20has%20also,million%20Responsible%20AI%20Adopt%20Program." target="_blank" rel="noopener noreferrer">Australian Government has also committed</a> A$41.2 million to support the responsible deployment of AI in the national economy. Further, in its 2023-2024 budget, the government allocated A$101.2 million over five years to support businesses in integrating quantum and AI technologies into their operations.</p> <p>A third inhibitor to generative AI adoption is the perceived maturity of generative AI solutions. While executives seem bullish about the capabilities of available solutions, they are looking for a wider and deeper array of generative AI solutions to unlock the next level of value and tackle more complex business challenges.</p>

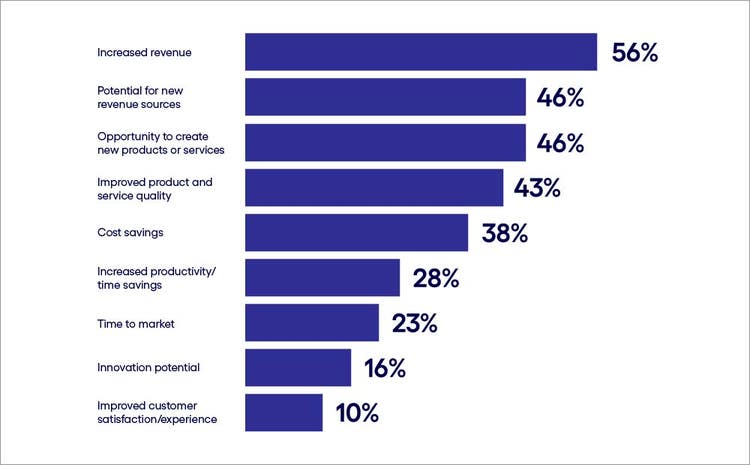

<h4>Sector spotlight: Stark differences in industries’ gen AI priorities</h4> <p>Of course, there are many use cases and strategies for using generative AI. As we’ve said, ANZ businesses are primarily focused on realizing productivity gains with generative AI, at least in the next two years. However, a look at what’s driving their business cases sheds a new light on productivity from how it’s been seen historically.</p> <p>Traditionally, businesses have equated automation productivity gains with cost-cutting: driving down the cost of output by reducing the number of people needed to get work done.</p> <p>While generative AI-driven automation will likely lower headcount to some degree, that is no longer the end goal. Instead, as seen through the metrics respondents will use to drive business cases, we see a shift toward redirecting productivity gains into funding endeavors that increase revenues or lead to entirely new revenue streams.</p> <p>The metrics ANZ respondents say will be most important for justifying generative AI expenditures include increasing revenues, discovering new revenue sources and creating new products and services all of which were named by at least 46% of respondents (see Figure 5). Conversely, metrics like cost savings, time-to-market and productivity were cited by 38% of respondents or fewer.</p> <p>In other words, the concept of productivity no longer stops at cost-cutting—businesses appear to be redirecting productivity gains into initiatives aimed at growth.</p> <p><b>Revenue is a top metric for justifying gen AI use cases</b><i></i></p> <p><i>Q: Which of the following metrics are most important in terms of justifying your organization’s generative AI business cases? (Percent of respondents naming each as a top-3 choice)</i></p>

#

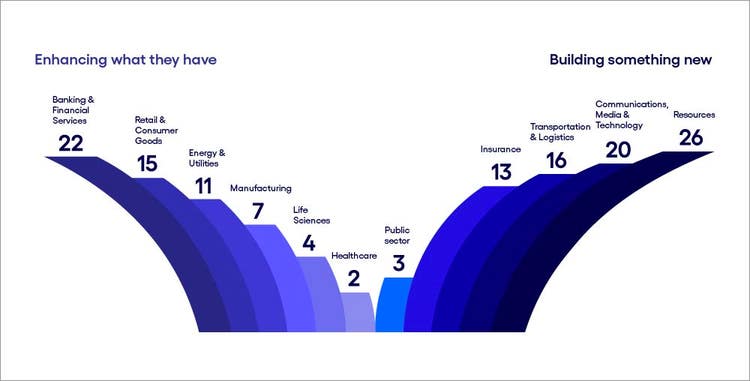

<p><span class="small">Base: 200 senior business leaders in ANZ<br> Source: Cognizant and Oxford Economics<br> Figure 5</span></p> <p>Using this more granular view of productivity goals and business drivers, we analyzed the differences in how industries intend to use the technology.</p> <p>Rather than focusing on the distinction between productivity vs. innovation, we grouped the metrics into two high-level categories of business use cases:</p> <ul> <li><b>Enhancing current business performance </b>(revenue, cost savings, time-to-market, productivity)</li> <li><b>Building something new</b> (new revenue sources, new or improved products, innovation)</li> </ul> <p>We then assigned each of the metrics a score to see the relative gap between a number-one-ranking metric and a number-three-ranking metric. By calculating the average score across industries, we could clearly see how each industry’s responses deviated from the baseline.</p> <p>Our analysis reveals stark differences among ANZ industries in terms of the business use cases they’ll likely prioritize (see Figure 6).</p> <p><b>Industries diverge on business cases</b><i></i></p>

#

<p><span class="small">Note: This figure depicts each industry’s relative deviation from a baseline of “zero,” using a ranked scoring of the top-three metrics respondents cite as important for justifying their generative AI use cases. It reveals a weighted view of each industry’s overall priorities for gen AI deployment.</span></p> <p><span class="small">Base: 200 senior business leaders in ANZ<br> Source: Cognizant and Oxford Economics<br> Figure 6</span></p> <ul> <li><b>The resources sector</b> is strongly focused on use cases whose metrics are based on developing new ways of working or creating new products and services. This is not surprising, as the sector includes mining—which alone represents nearly 15% of the Australian economy. The mining industry has rapidly become a hotbed of innovation, with R&D spending driving significant advancements in mining technology. <a href="https://minerals.org.au/wp-content/uploads/2022/12/The-Digital-Mine\_2022.pdf" target="_blank" rel="noopener noreferrer">According to the Minerals Council of Australia</a>, Australia's mining industry has invested over $30 billion in R&D since 2005.<br> <br> One of the largest miners in the region, Rio Tinto, embeds a range of technologies, including analytics, artificial intelligence, machine learning and automation, to power its <a href="https://www.riotinto.com/en/mn/about/innovation/smart-mining" target="_blank" rel="noopener noreferrer">Smart Mining strategy</a>—powering outcomes from increased safety to autonomous vehicles.<br> <br> In the future, mining experts believe generative AI, alongside other technologies, will play a vital role in discovering new metal deposits—opening up new revenue streams for operators. Indeed, mining giant <a href="https://www.bhp.com/-/media/documents/media/reports-and-presentations/2024/240220\_bhpresultsforthehalfyearended31dec2023\_exchangerelease.pdf" target="_blank" rel="noopener noreferrer">BHP announced in its H2 2023 results</a> that it intended to pilot exploration trials using generative AI. This work extends from a successful proof of concept of the technology in HY24, which achieved early success in retrieving information from large, unstructured government datasets.<br> <br> </li> <li><b>The communications, media and technology sector</b> is similarly focused on building new capabilities using generative AI. The region’s big tech firms—including Atlassian, REA Group and Xero Ltd.—have all been vocal about incorporating gen AI into their products, services or operations.<br> <br> In telecom, <a href="https://media.one.nz/gen-ai" target="_blank" rel="noopener noreferrer">One NZ</a> has already leveraged generative AI to enhance contact center operations by anticipating customer inquiries and facilitating proactive resolution. Now, the company aims to <a href="https://www.reseller.co.nz/article/1311461/one-nz-scales-up-ai-investment-eyes-new-fibre-co.html" target="_blank" rel="noopener noreferrer">further harness AI</a> to automate marketing campaigns, craft personalized offers, boost lead generation and manage accounts. Looking ahead, One NZ envisions continuous AI-driven campaigns delivered in real-time, proactive AI services for issue prediction and resolution, an automated network development and maintenance program with self-optimizing capabilities, and AI-enhanced engagement and operations.<br> <br> In the media industry—amid uncertain sentiment from readers and industry peers—media giant NewsCorp <a href="https://www.theguardian.com/media/2023/aug/01/news-corp-ai-chat-gpt-stories" target="_blank" rel="noopener noreferrer">recently announced</a> its local teams produce 3,000 weekly Australian news stories. The organization has turned to generative AI to create "hyperlocal" content.<br> <br> </li> <li><b>The banking sector,</b> meanwhile, is directing most of its investments toward enhancing current business performance—boosting existing revenue streams, driving down costs and increasing worker productivity. This strategy makes sense given recent <a href="https://www.fitchratings.com/research/banks/australian-banks-earnings-headwinds-to-persist-into-2024-13-11-2023" target="_blank" rel="noopener noreferrer">research from Fitch Ratings</a>, which points out the four major Australian banks' earnings will remain under pressure through 2024 as competition for mortgage loans and higher funding costs will continue to dampen net interest margins.<br> <br> Australian banking giant Commonwealth Bank advised it had "50-plus generative AI use cases to simplify operational processes and support our frontline to serve customers," with much of the work taking place late last year. Use cases include using generative AI in call centers to answer complex questions by finding answers from 4,500 documents' worth of bank policies in real-time.<br> <br> </li> <li><b>The energy and utilities sector</b> is ploughing a similar furrow. <a href="https://www.cxnetwork.com/artificial-intelligence/interviews/how-energy-queensland-is-using-generative-ai-to-transform-customer-billing" target="_blank" rel="noopener noreferrer">Energy Queensland uses the tech to handle customer billing</a> and help staff respond to unstructured customer queries.</li> </ul>

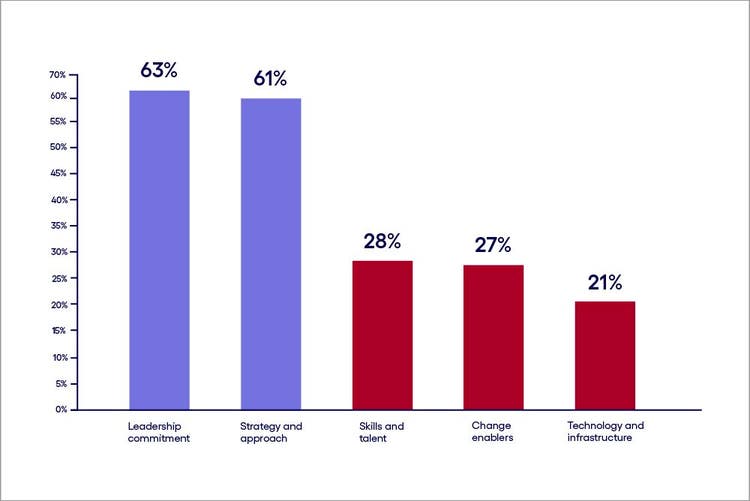

<h4>Business constraints: Talent shortages and shaky technology foundations</h4> <p>A remaining question is whether businesses are ready to drive real value from these business cases.</p> <p>The answer, according to our research, is mixed. To better understand how prepared executives believe their business is to adopt generative AI, we asked respondents to rank their organization’s maturity on a scale of 1 to 4 by selecting a statement that best described their organization in the following five areas, from low maturity to high:</p> <ul> <li>Organizational agility</li> <li>Leadership commitment</li> <li>Skills and talent</li> <li>Strategy and approach</li> <li>Technology and infrastructure</li> </ul> <p>The message from business leaders in the ANZ region is evident: Leadership commitment is high, and strategies are robust (perhaps a testament to the multimillion-dollar investments most respondents report). However, the fundamental operational and technological building blocks necessary to adopt the technology are lacking (see Figure 7).</p> <p><b>Leadership support is sound, but fundamentals are lacking</b></p> <p><i>Respondents were asked to rate the maturity of their organization's operations in relation to generative AI. (Percent of respondents rating each as a 3 or 4, with 4 representing the highest level of maturity)</i></p>

#

<p><span class="small">Base: 200 senior business leaders in ANZ<br> Source: Cognizant and Oxford Economics<br> Figure 7</span></p> <p>Unsurprisingly, given that talent shortages sit high on the list of the biggest inhibitors impacting the region, respondents assign low ratings to the maturity of their business’s skills availability and talent strategy. When it comes to the underlying tech infrastructure, while data quality is rated high (52% rate it as good or excellent), many other foundational aspects are lacking. These include the ability to comply with company rules, policies and frameworks, data security and customer privacy. All of these technology infrastructure capabilities achieved the lowest two ranks by the majority of respondents.</p>

<h4>Path to success: Strategic recommendations for ANZ businesses</h4> <p>ANZ is an “accelerating” region when it comes to generative AI momentum. The challenge ahead is to take full advantage of the factors that could encourage gen AI strategy success while overcoming the inhibitors.</p> <p>To navigate these challenges, executives should prioritize the following actions:</p> <ul> <li><b>Develop pragmatic partnerships to shore up skills</b>: ANZ businesses will need to create an ecosystem of partnerships that foster talent development and innovation. To start with, strategic partnerships with educational institutions can provide tailored training programs, equipping the workforce with essential AI skills. Collaborations with startups can bring in innovative solutions and rapid prototyping capabilities, while partnerships with government bodies can offer funding, regulatory support and infrastructure development. Indeed, 44% of respondents say they would like to see direct government funding to support retraining and reskilling efforts.<br> <br> But beyond this, businesses in the region recognize they’ll need pragmatic support from experts—47% of respondents are looking to partner with consultants on AI. The aim here, given the speed of change and the myriad hurdles to overcome is to find a pragmatic partner that can help leapfrog challenges, assume risk, and transform the business, enabling them to become truly ready to face the future.<br> <br> </li> <li><b>Invest in AI literacy and training</b>: While 54% of ANZ businesses plan to implement upskilling programs for employees in specific roles, only 21% plan organization-wide training programs. This is short-sighted.<br> <br> Investing in AI literacy ensures employees understand AI potential and limitations, fostering a culture of innovation and continuous learning. Comprehensive training programs can bridge the skills gap and encourage adoption, facilitating the integration of AI into existing operations and the development of new business models. Businesses need to prioritize AI literacy to drive growth and competitiveness.<br> <br> </li> <li><b>Prepare operations for generative AI</b>: Our research indicates that most ANZ businesses expect generative AI to make an impact in less than five years. This provides business leaders with a window of opportunity to mature their technological foundations and operating models. This preparation involves technological upgrades and refining processes and workflows to accommodate AI-driven innovations.<br> <br> </li> <li><b>Balance leadership enthusiasm with measurable results</b>: A key finding from our study is the strong leadership commitment to AI, demonstrated by significant investments and strategic initiatives. However, businesses must balance this enthusiasm with tangible results.<br> <br> Leaders should focus on practical use cases and pilot projects to identify viable business cases and demonstrate real value. Businesses can build a solid foundation for AI adoption that aligns with their strategic objectives by iterating through experiments and refining their approach.</li> </ul> <p><i>*The full list of regional factors we evaluated includes: the flexibility of the existing operating model, market demand for gen AI-enabled products and services, data readiness, quality of output from gen AI, availability of compute power, cost/availability of gen AI-related technologies, shareholder/investor sentiment, regulatory environment, sustainability, national infrastructure, cost/availability of capital, data privacy and security, existing technology infrastructure, current and prospective employee perceptions, flexibility of the existing business model, maturity of gen AI-related technologies, consumer perceptions and cost/availability of talent.</i></p> <p><i>Learn about the impact of generative AI on jobs and the economy in our report </i><a href="https://www.cognizant.com/us/en/gen-ai-economic-model-oxford-economics" title="https://www.cognizant.com/us/en/gen-ai-economic-model-oxford-economics" target="_blank" rel="noopener noreferrer"><i><b>New Work New World</b></i></a><i>.</i></p>

Jump to a section

Introduction #spy-1

Inhibitors and accelerators: The forces that shape AI momentum #spy-2

Sector spotlight: Stark differences in industries’ gen AI priorities #spy-3

Business constraints: Talent shortages and shaky tech foundations #spy-4

Path to success: Strategic recommendations for ANZ businesses #spy-5

<h5>Authors</h5>

<p>Michael has 25 years' experience designing and implementing Advanced Analytics, AI / ML solutions for clients across industries and across the globe. He is passionate about helping customers drive towards greater adoption of Data-Driven Decision Making.</p>

<p>Ollie O'Donoghue leads Cognizant Research, leveraging over a decade of experience as an industry analyst and consultant. His primary focus is on understanding the impact of new economic and technological trends on businesses and industries.</p>