Becoming a finance superhero styles-text-white

<p><br> April 12, 2023</p>

Becoming a finance superhero

<p><b>How CFOs can meet, and exceed, a new era’s expectations.</b></p>

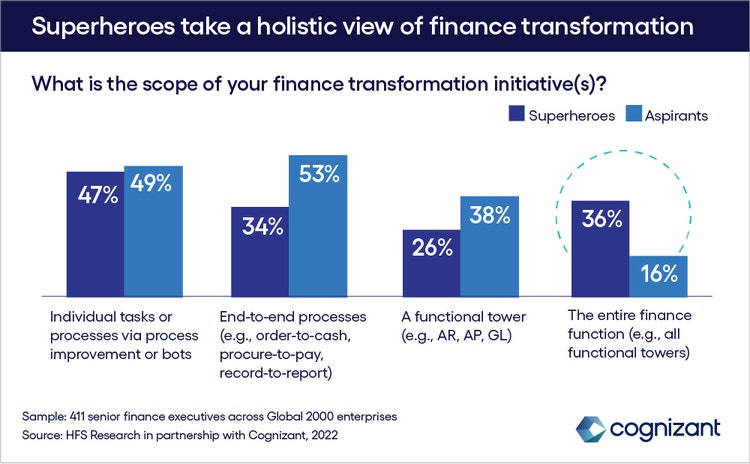

<p>The job of a Chief Financial Officer is changing. Formerly somewhat passive figures within an organization, responsible for filing monthly reports, keeping track of costs and meeting external metrics of compliance, today’s CFOs are under increased pressure to actually <i>drive</i> the growth of a business, not just report on it and make sure that it comes in under budget. Indeed, recent research conducted in partnership with HFS, Cognizant found that 90% of finance executives now consider driving growth to be at the core of the modern finance function.</p> <p>But we also found a lot of anxiety. Of the finance leaders surveyed, only 12% said that they and their organizations are living up to this new set of expectations. Some may have been too hard on themselves; when the executives graded their own firms’ performance in four categories of finance-function success—Cost, Control, Influence and Outcomes—the percentage of firms getting optimal or near-optimal performance from their finance functions was more like 25%—a top quartile we’ll call the ‘finance superheroes.’</p> <p>What makes the superheroes different? In a word: mindset. To a striking extent, the surveyed firms who made it to Superhero status were the ones most willing to embrace a new, more agile and integrated approach to the finance function.</p> <p>How does this mindset manifest in practice? What concrete changes can aspiring Superheroes make to join the ranks of the gifted elite? Let’s find out.</p> <h4>Defeating organizational siloes</h4> <p>The first area in which superheroes stand out from the crowd is in their willingness break down barriers to internal collaboration and to dismantle the organizational ‘siloes’ compartmentalizing their finance function. Rather than treating their firm’s component parts as discrete units, each with its own lines of communication ‘upwards’ to the finance team, Superhero finance organizations are far more likely to drive holistic transformation programs that encompass the entire finance function. (36% percent of ‘superheroes’ are driving transformation programs across all functional towers, compared to just 16% of ‘aspirants’). Superhero finance teams seamlessly integrate their work with adjacent, top-level enterprise functions—such as Procurement, Supply Chain, CRM, and ERP.</p>

#

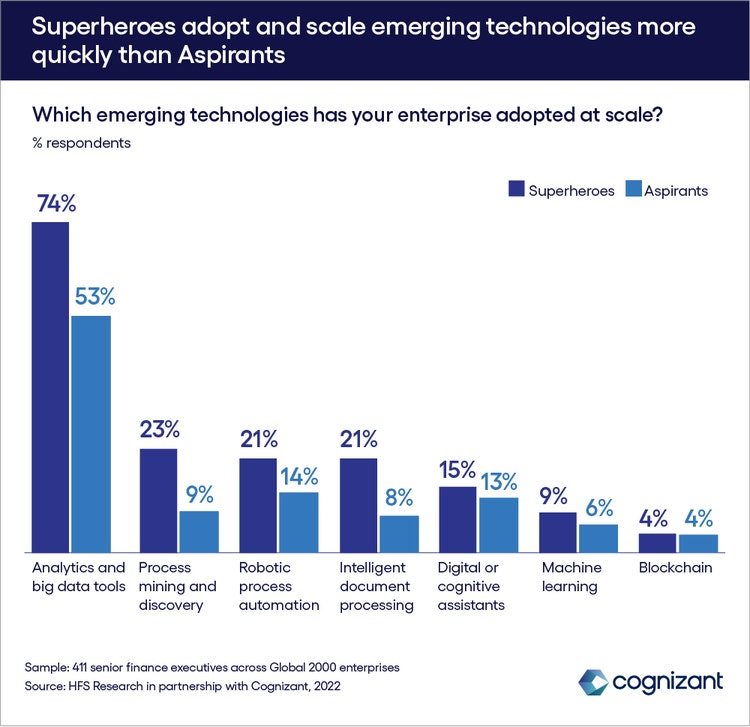

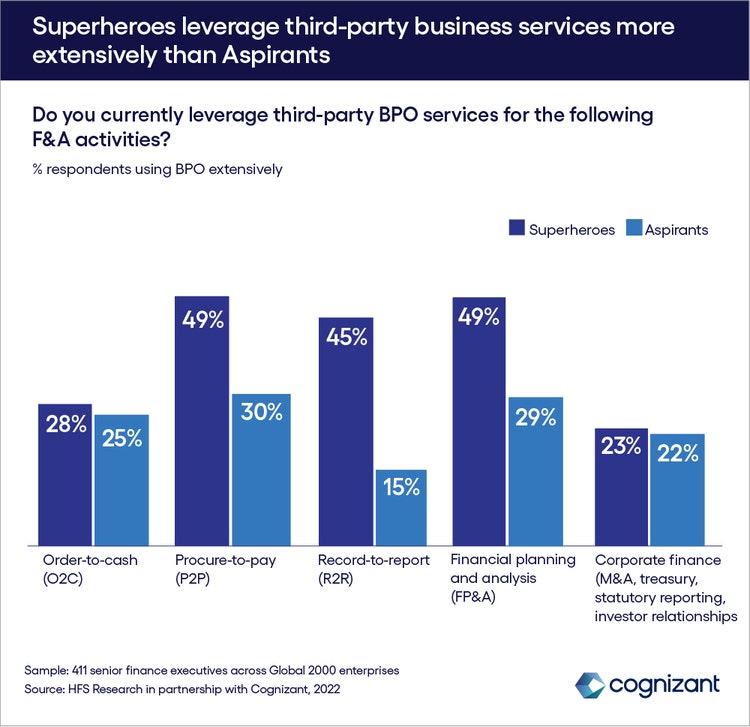

<p><span class="small">Figure 1</span></p> <p>Furthermore, superheroes are far more likely to extend this a broader ‘ecosystem’ approach to partners <i>beyond</i> the four walls of their business. Not only are superhero firms far more likely to leverage third-party BPO services in core F&A process areas—49% of superheroes leverage third party support for Procure-to-Pay processes, for example, compared to just 30% of their peers—they also increasingly use external experts to assist them on the strategic aspects of the modern finance function. Fully 49% of superhero finance leaders leverage third parties to support Financial Planning and Analysis work, for example, compared to 29% of those lowest-performing three quartiles that we’ll call the “Aspirants.”</p> <p>This focus on integration pays dividends, if implemented with care. Consider <a href="https://www.cognizant.com/us/en/case-studies/manufacturing-process-erp-system-integration" target="_blank" rel="noopener noreferrer">Cognizant’s work with a global water technology company</a>, which needed support in harmonizing the operations of disparate businesses the firm had acquired. After assessing the company’s business processes and technology operations, Cognizant recognized that a single, integrated ERP system would be an extremely costly and time-consuming solution. Instead, we built an orchestrated operating model that pulled together and synchronized each acquired company's existing ERP systems. The result? An across-the-board 50% reduction in the cost of operations and $25 million in savings.</p> <h4>Slaying legacy technology dragons</h4> <p>Another area where superheroes distinguish themselves, is in their willingness to break with ‘legacy’ technologies and push forward with ambitious modernization strategies. In the cloud computing space, for example, superheroes lead the pack in migrating core ERP into the cloud, implementing functional SaaS providers to complement capabilities, and leveraging workflow technologies such as ServiceNow or Pega. 21% of Superheroes have embraced Intelligent Document Processing, we also found, compared to the average among Aspirants of only 8%. A slightly larger gulf is clear in the adoption of process mining and discovery tools—with 23% of superheroes leveraging the technology, compared to just 9% of their peers.</p>

#

<p><span class="small">Figure 2</span></p> <p>The benefits for companies pushing ambitious modernization programs are clear. In a recent partnership with a leading cloud-based software company, Cognizant conducted a series of audits—including of the firm’s process for creating Accounts Receivable Aging reports—which led to a redesign of the end-to-end AR process by establishing standard operating procedures (SOPs) for collections and billing agents. Cognizant’s data scientists also analyzed customer payment patterns, while working closely with agents to understand and address their challenges, leading to the implementation of a new CRM system. This sweeping upgrade of process efficiency delivered considerable results to the business, including $200m in additional cash flow.</p> <h4>Investing in people</h4> <p>This more integrated, multidisciplinary approach to the finance function requires a new and broader set of skills from finance executives. No surprise then, that Superhero companies are happy to devote significant time and resources on developing, retaining, reskilling and attracting talent for their finance teams. Once again, we also find that high-performing finance teams are comfortable leveraging outside partners to plug any internal skills gaps. In every key process areas, firms ranked as superheroes were more willing than Aspirants to enlist the help of external services.</p>

#

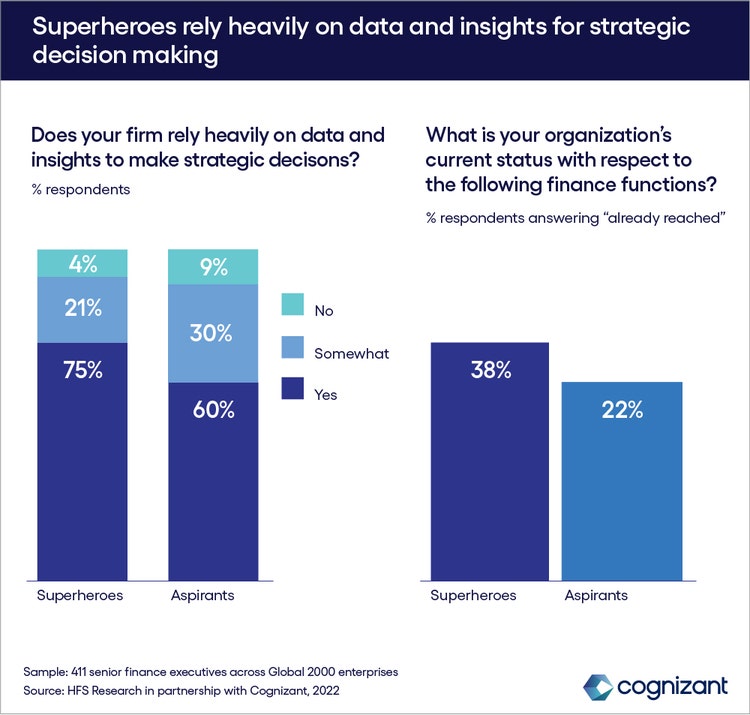

<p><span class="small">Figure 3</span></p> <p>Solving for the rapid evolution of talent and skills requirements in the modern finance function is, perhaps, the Superhero trait that requires the most radical rethinking of the traditional way of doing things. As the report bluntly advises those aspiring to Superhero status: “the talent profile you likely need is the inverse of what you have now.”</p> <h4>Data is a superpower</h4> <p>Driving growth isn’t the only new expectation placed on Superhero CFOs. They are also expected to bring new levels of creativity and forward-thinking to one of their traditional roles: helping shape long-term business strategy. Here, a shift in mindset will only take Aspirants so far. To make it into the ranks of the Superheroes, they need to discover, and masters, the three sources of all Superheroes’ power: data, data and more data. Here, again, we see Superhero firms leading the way with new technology; 38% of Superhero firms use real-time analytics and AI in their decision-making, for instance, compared to just 22% of Aspirants.</p>

#

<p><span class="small">Figure 4</span></p> <p>Moreover, the technology investment roadmaps of Superheroes reveal their determination to keep building out their data capability—74% of Superheroes are adopting analytics and big data tools, for example, compared to the Aspirant average of just 53%.</p> <p>What makes data so powerful? Consider Cognizant’s recent partnership with a European automaker looking for greater clarity in their finance function. Recognizing that their existing ERP system failed to generate information efficiently, Cognizant devised a solution including the creation of a Smart Audit tool, powered by machine learning, to increase efficiency, reduce sampling, and improve risk coverage. Crucially, the solution also included a C-Level executive dashboard to provide a multidimensional view of F&A business metrics. The result? Over 80% open aging items reconciled, 99.9% improved risk coverage of AP records, and an estimated $500 million in business value delivered.</p> <p>In this instance, crucially, the partnership with Cognizant was an ongoing engagement. Because the automaker’s businesses processes had increased in complexity, Cognizant stayed involved throughout the adjustment process letting us promptly address any “teething troubles” as they arose. When the automaker’s centralized ERP system failed to generate information efficiently, for instance, we proposed improving key internal accounting processes using our OneFinance program to review existing non-standardized workstreams and develop a best practice template for each workstream. These templates would be adopted globally and interoperate seamlessly with SAP, the ubiquitous ERP software. Partnering with the company’s procurement teams, we defined strategies, framed an operating model, then developed a process to address variances in systems and processes for each country. In short, by playing a vital role in running the operations of the company, and facilitating the gathering, sharing and free flow of data, Cognizant was well placed to help them ascend from the aspiring ranks of mere mortals, at pace and at scale, and finally don the cape of the modern finance Superhero.</p> <p><i>To learn more, visit the </i><a href="https://www.cognizant.com/us/en/services/business-process-services" target="_blank" rel="noopener noreferrer"><i>Intuitive Operations and Automation</i></a><i> section of our website or </i><a href="https://www.cognizant.com/us/en/services/business-process-services#contact-us" target="_blank" rel="noopener noreferrer"><i>contact us</i></a><i>.</i></p> <p><i>This article was written by Juan Diaz, Head of Digital Finance BPO UK&I in Cognizant’s Intuitive Operations and Automation practice.</i></p>

<p>We’re here to offer you practical and unique solutions to today’s most pressing technology challenges. Across industries and markets, get inspired today for success tomorrow.</p>