What open finance really means for building societies styles-h2 text-white

What open finance really means for building societies

The past six months have seen a surge in dialog surrounding the purported value of “open finance” and whether or not its potential has been realized in the UK. We see open finance as the natural evolution of finance—a collection of standards, technologies and organizations that enables consumers to access reimagined credit, asset management, insurance and pension products with greater ease and transparency from a range of bank and non-bank suppliers.

While the debate has stoked critical thinking around what financial institutions can hope to achieve through open finance, large questions remain around the potential benefits still on the table.

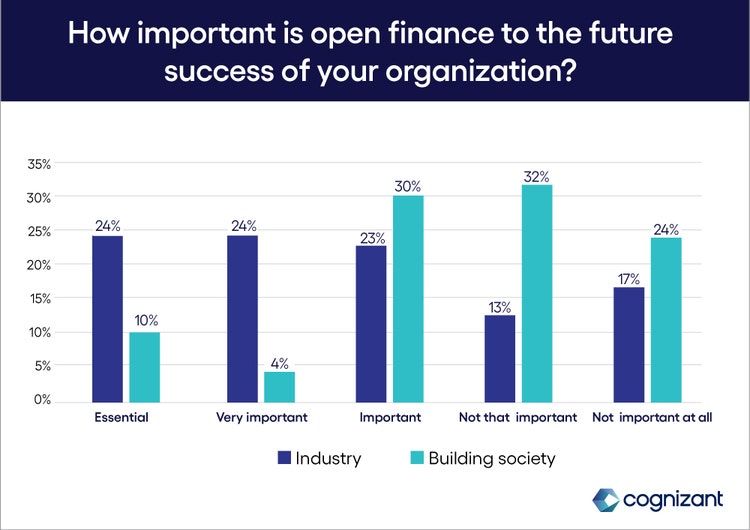

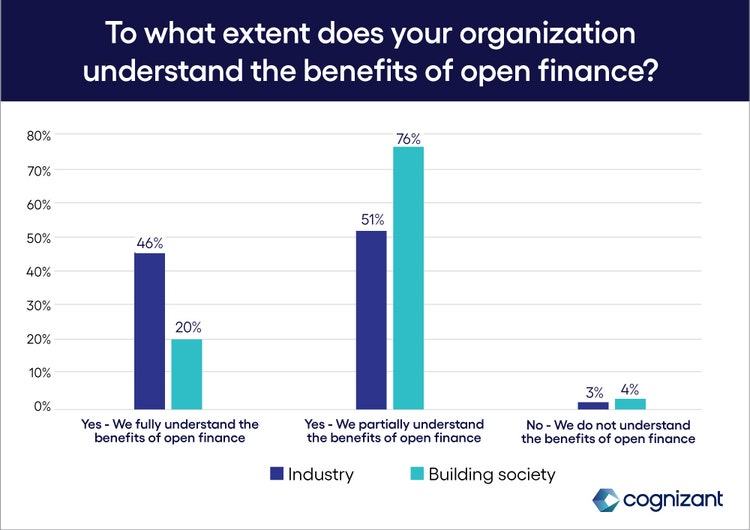

To better understand how financial institutions are approaching open finance, between April and July 2022, we surveyed over 200 decision makers with responsibility for open finance within their organizations. Respondents were drawn from a representative cross-section of leaders from within the CMA9, building societies and incumbent, challenger and neo banks.

Through our research, we discovered a paradox in financial institutions’ approach to open finance. The paradox is two-pronged: First, there’s a marked inconsistency in the models that different financial organizations are using to align with the concept; second, business and investment priorities are frequently misaligned in areas where open finance could help institutions achieve their goals.

In this series, we explore the differing priorities, strategies and opinions among financial institutions to investigate the current state of play and the likely direction of travel—whether they’re confidently embracing open finance or reluctantly doing the bare minimum to comply with regulation.

“Our customers enjoy the social, human interaction of being regular branch users. They come in weekly, withdraw some money and have a conversation—they really value the full branch experience. Knowing somebody down the high street with whom, should they have a problem, they can walk in and have a conversation [is important to our] customers.” – Digital Branch Manager, UK Building Society

“Young people are engaging with banking in a fundamentally different way. I think there's an opportunity: Gen Z, etc., are looking for digital community and ‘fairer finance,’ and I think building societies have an opportunity to play in that space.” – Digital Branch Manager, UK Building Society

“If building societies don't act, they risk obsolescence. They should look to embrace open finance in different ways. But they have to do something. Doing nothing is not an option.” – Chris Allen, Director, Banking & Financial Services Consulting, Cognizant