How manufacturers can move beyond operational efficiency to be future-ready styles-h2 text-white

<p><span class="medium"><br>September 13, 2022</span></p>

How manufacturers can move beyond operational efficiency to be future-ready

<p><b>To become future-ready, manufacturers need to focus on data strategies, rich customer experiences, workforce upskilling and action-backed sustainability goals.</b></p>

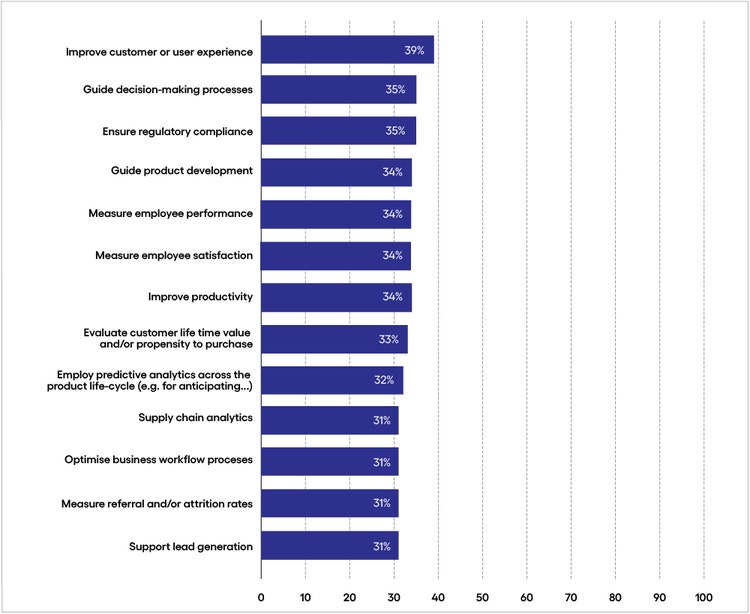

<p>The manufacturing industry has historically been at the head of the pack when it comes to innovation and the application of advanced technology. However, an onslaught of challenges accelerated by the pandemic is forcing manufacturers to both consolidate their position as technology leaders and make advances in new areas. </p> <p>For example, while operational efficiency has long been a goal, the go-to cost-savings measure of offshoring production and supplies has been impaired by geopolitical tensions, competitive labor markets and a need to rebalance facility location. Efficiency with resiliency is the new goal.</p> <p>As a result, manufacturers are seeking new ways to build resilience and efficiency into their operations. Beyond tech investment, this means creating comprehensive data strategies that leverage the information flowing from increasingly connected environments, and building rich customer experiences, in addition to other priorities that focus on efficiency enhancement. </p> <p>Further, while manufacturers have traditionally focused on business-to-business relationships, many now find themselves in the consumer spotlight. B2B models are morphing into “B2B2C” (business-to-business-to-consumer) models as organizations search for differentiation and new revenue streams, such as through the digitization of products and services. </p> <p>Meanwhile, modern consumers are taking a keen interest in how and where their products are made. Emissions, environmental impact and social responsibility now form part of the consumer decision-making process, which pushes manufacturers closer to those who buy and use their products.</p> <p>As Economist Impact research supported by Cognizant demonstrates, all these factors combined mean that an industry previously obsessed with driving down costs is going through something of a brand refresh. The image of a grubby factory floor has been banished to the history books. From the automotive industry to packaging suppliers, manufacturers are now striving to be high-tech and sustainable businesses. Only by backing up this progressive image with tangible action will manufacturers be ready for the future.</p> <h4>Heavy tech investment needs to be paired with a strong data strategy<br> </h4> <p><em>Respondents were asked to identify the areas in which their company is leveraging data. (Percent of respondents using data in each area)</em></p>

#

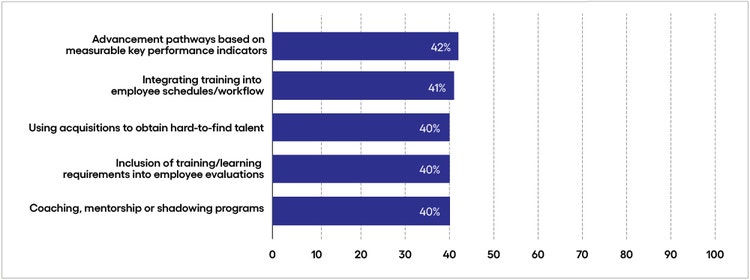

<p><span class="small"><br> Response base: 250 senior manufacturing executives <br> Source: Economist Impact Survey 2022<br> Fig 1</span></p> <h5>What they're good at</h5> <ul> <li><b>Creating a solid tech foundation. </b>In their pursuit of smart factories and automated production lines, manufacturers have turned core technology investments, such as cloud, Internet of Things (IoT) and robotics, into table stakes. Over 80% of respondents have adopted or plan to adopt each of these technologies.<br> <br> The quest for high-tech operations means technologies such as robotic process automation and big data analytics are also seeing high adoption rates, reflecting a need to pull data from disparate systems and drive valuable insights.</li> </ul> <h5>Long way to go</h5> <ul> <li><b>A data strategy is needed to tie it together. </b>Despite the wealth of data generated by IoT, cloud and 5G, many manufacturers lack robust data strategies to glean real value. For example, just 38% of respondents are using data to improve the customer experience. And less than one-third are deploying supply chain analytics—despite several years of serious challenges in the space. This is worrying; without identifying a prioritized use for their data, businesses will struggle with managing, structuring and storing it.</li> </ul> <h5>The importance of bridging the gap</h5> <ul> <li><b>New revenue streams await. </b>In addition to using innovative tech such as artificial intelligence (AI) or other forms of intelligent automation, manufacturers also stand to benefit from the monetization of the data they create. For many, the strategic imperative is to use data to open new revenue streams by designing premium support capabilities based on predictive analytics, or offering predictive maintenance, asset utilization or productivity optimization services to customers at a premium.<br> <br> Despite this, less than one-third of respondents are feeding data directly into sales initiatives, such as supporting lead generation, and a similarly low percentage funnel data into predictive analytics.</li> </ul> <h4>Competition for digital skills requires a new approach to workforce development</h4> <p><i>Respondents were asked to identify the initiatives they use to support talent cultivation in their company. (Percent of respondents taking action on each)</i></p>

#

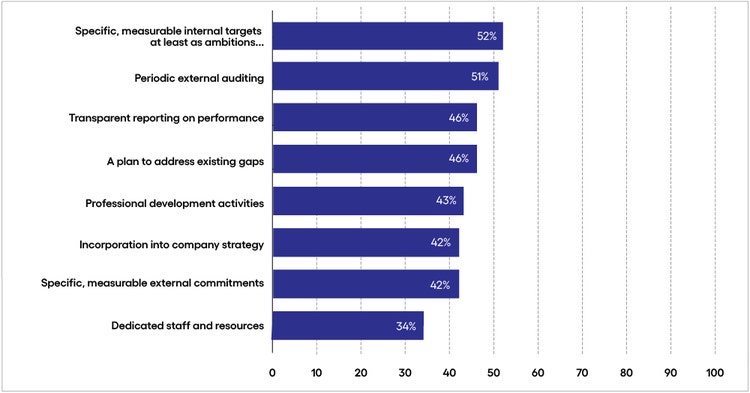

<p><span class="small">Response base: 250 senior manufacturing executives <br> Source: Economist Impact Survey 2022<br> Fig 2</span></p> <h5>What they're good at</h5> <ul> <li><b>Providing a digital career path. </b>There’s no doubt that<b> </b>the skillsets required for modern manufacturing are becoming more digital. Manufacturers have recognized that providing career progression and advancement is the best way to retain and cultivate digital talent in a hyper-competitive market.</li> </ul> <h5>Long way to go</h5> <ul> <li><b>Leveraging institutional knowledge. </b>While 93% of respondents agree that talent readiness is very important to future readiness, fewer than half are taking action on talent management strategies. If advancement pathways are not in place and training is not provided, it will be easier than ever for employees to take their skills into other industries.<br> <br> Moreover, employees with institutional knowledge aren’t being sufficiently leveraged; only 39% of respondents are implementing coaching and mentorship programs.</li> </ul> <h5>The importance of bridging the gap</h5> <ul> <li><b>Promoting an industry of opportunity. </b>Manufacturing is a tech-heavy industry, but it must better leverage its advantages in this space to change the perception of the industry. While the sector has long struggled to woo digital talent, manufacturers can attract skilled workers by promoting its investment in technology, efforts toward data monetization and focus on sustainability.</li> </ul> <h4>ESG: beyond regulatory requirements</h4> <p><i>Respondents were asked to identify actions their organization were taking to improve their environmental sustainability and social impact. (Percent of respondents selecting each measure)</i></p>

#

<p><span class="small">Response base: 250 senior manufacturing executives <br> Source: Economist Impact Survey 2022<br> Fig 3</span></p> <h5>What they're good at</h5> <ul> <li><b>Tech infrastructures and intentions are in place.</b> While manufacturing can be a carbon- intensive industry, 92% of respondents understand that becoming environmentally sustainable is crucial to being future-ready. Fortunately, the same infrastructure that manufacturers have invested in to promote efficiency and resilience can be applied to sustainability.<br> <br> Setting targets and reporting on them is a priority, often due to legislation. Beyond that, becoming sustainable is about efficiency and resilience. </li> </ul> <h5>Long way to go</h5> <ul> <li><b>Backing sentiment with action.</b> Most manufacturers are struggling to capitalize on the data, technology and process advantages they possess. Just over half of respondents say they are setting sustainability targets, and few are applying data to these efforts. IoT sensors, cloud infrastructure and big data analytics are ready and waiting to provide what is needed, but almost half of manufacturers are not applying these tools to achieving their sustainability and social goals.</li> </ul> <h5>The importance of bridging the gap</h5> <ul> <li><b>From regulatory requirement to business imperative.</b> Beyond regulatory compliance and risk mitigation, manufacturers need to see sustainable business as good business. With ongoing supply chain issues bound to be exacerbated by climate-related disasters, and consumers increasingly interested in sustainable products and services, manufacturers need to double down on efficiency and resilience, while putting sustainability at the heart of their business.</li> </ul> <p><i>To learn more, visit the <a href="/content/cognizant-dot-com/us/en/insights/modern-business.html" target="_blank" rel="noopener noreferrer">Modern Business</a> section of our website or <a href="/content/cognizant-dot-com/us/en/about-cognizant/contact-us.html" target="_blank" rel="noopener noreferrer">contact us</a>.</i></p> <p><i>The views and opinions expressed in this report are those of Cognizant and do not necessarily reflect the view and policies of Economist Impact. Data presented is from an Economist Impact executive survey, commissioned by Cognizant, conducted in early 2022.</i></p> <p><i>This article was written by Gautam Sardar, Ph.D., Assistant VP and Consulting Practice Leader in Cognizant’s Manufacturing and Logistics Practice, and Duncan Roberts, Senior Manager in Cognizant Research.</i></p>

<p>We’re here to offer you practical and unique solutions to today’s most pressing technology challenges. Across industries and markets, get inspired today for success tomorrow.</p>