<p><br> <span class="small">August 11, 2021</span></p>

Time for health plans to deliver engaging digital

<p><b>Our latest member survey reveals where health plans are challenged to achieve adoption of and optimal returns on their digital investments. Here are the recommended actions to ensure that payers can build strong consumer engagement with their digital tools and across these interactions.</b></p>

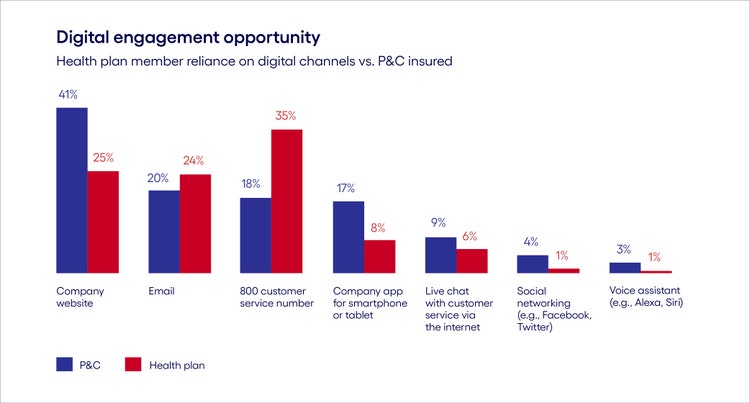

<p>Digital is the bright thread that runs through attracting consumers: driving enrollment, supporting transactions and engaging and retaining members.<b> </b>Despite payer’s significant investments in telehealth, mobility and digital self-service tools, <a href="https://www.cognizant.com/en\_us/general/documents/cognizant-hfs-health-consumers-want-digital-its-time-for-health-plans-to-deliver.pdf" target="_blank" rel="noopener noreferrer">our latest health plan consumer adoption<b> </b>survey </a>indicates that payers remain challenged in achieving meaningful adoption of and optimum returns from their digital investments.</p> <p>Beginning in 2016, we have conducted biennial studies into consumer adoption of technologies to help payers better understand what digital tools and experiences members expect. For our 2021 study, HFS Research partnered with us, surveying more than 2,400 US health plan members across employer sponsored plans, individual plans, Medicare and Medicaid.</p> <p>The study reveals health plan members’ use of technologies and the digital interactions that health consumers want. These findings will help payers set priorities for continued digital investments to build sustainable member engagement this year and into the future. Key findings and our recommended actions include the following:</p> <ul> <li><b>Members have embraced the use of digital channels to shop for plans, enrollment, provider search, claims and more.</b> Members’ digital interactions with health plans in 2020 via a website or mobile app were more than double those via traditional channels (phone, mail or in-person) across demographics and coverage type. The use of digital tools by members has grown almost 25% since our <a href="https://www.cognizant.com/en\_us/insights/documents/extending-the-case-for-digital-health-plan-members-speak-codex3814.pdf" target="_blank" rel="noopener noreferrer">2018 findings</a>.<br> <br> </li> <li><b>Digital adoption rates remain inconsistent.</b> Despite the general overall preference for digital channels, use of mobile apps, social media and even health plan websites remain low. Approximately 70% of members have not downloaded their health plan’s mobile app, 90% are not following their health plan on social media, and 45% are not registered on their plans’ member portals.<br> <br> Adoption is low among healthy members and those over 50 years old. Rates are higher among younger cohorts. Interestingly, those 50 to 64 years old use many digital tools at rates similar to those of younger cohorts. The oldest members of this group will soon be Medicare beneficiaries and will expect the availability of digital tools and experiences as they transition into those plans.<br> <br> Evidence from property and casualty (P&C) insurers indicates that insurance consumers are open to using digital channels. P&C insurers have a significantly higher digital adoption rate than health payers (see below graphic). This is true despite the health insurance market having a greater number of member-initiated transactions compared to P&C insurance. Health plan members make more doctor visits and have more provider claims compared to the number of car accident claims. Yet, digital adoption among P&C insurers significantly exceeds that of health payers.<br> <b><br> Recommended actions<br> <br> </b>Payers have opportunities across age cohorts to expand the adoption of digital tools. For payers still making initial digital investments, the findings indicate that members put a high value on provider search, cost estimation tools, appointment scheduling and paying provider bills. Payers with more mature digital capabilities can improve digital adoption through targeted campaigns and realize greater value from their investments. All must continue to invest in new and emerging digital capabilities.</li> </ul>

#

<p><span class="small">Source: HFS Research in partnership with Cognizant, 2021<br> Figure 1</span></p> <ul> <li><b>Adoption is adversely affected by a gap between member needs and available digital tools and features.</b> Members indicated that the digital tools and features they rank as important are not always available and when they are, they do not meet expectations. For example, members rated the importance of consolidated billing (paying provider bills) as greater than 50%, but this service ranked lowest in availability (18%) and satisfaction (12%).<br> <br> Members ranked “provider search” highest in importance and most indicated that their health plans had this feature. However, only 19% said they were satisfied with their search experience. Similarly, more than 60% said “scheduling appointments” is an important feature but only 25% said this feature was available and only 11% were satisfied with it.<br> <b><br> Recommended actions<br> <br> </b>Payers could create self-service features that members say are of high importance and/or improve existing features that do not satisfy members. The survey indicates key areas to focus on include searching for health providers; determining estimated costs for procedures; looking up benefits; accessing plan options, reviews and features; requesting, accessing and submitting claims; scheduling appointments; paying provider bills; and computing out-of-pocket expenses. A positive sign of adoption is when these digital features move traffic from higher-cost channels such as the contact center to self-service-based digital channels. Correlating call center data with digital interactions could help payers better understand why members are not using self-service channels.</li> </ul>

<ul> <li><b>The ability to compute out-of-pocket expenses has grown in importance</b> since the 2018 study, suggesting that investments in digital tools that deliver transparency, cost estimates and wellness information should be key priorities. Commercial and Medicare plan members report only 37% satisfaction with their payments and claims experience.<br> <b><br> Recommended actions<br> <br> </b>Addressing out-of-pocket cost calculations and streamlining claims will have wide-ranging benefits across all payer lines of business. These steps also will help payers comply with the federal price transparency rule. Payers with modern core administrative systems may implement tools that orchestrate personalized plan member data including coverage, deductibles, cost sharing and provider networks to empower members to generate personalized treatment cost estimates on demand.</li> </ul>

<ul> <li><b>COVID-19 has established telehealth as a permanent healthcare delivery channel with a net usage increase of 24%.</b> Convenience and cost were cited as the primary reasons for increased use. Yet while telehealth adoption grew, member awareness of their health plans’ telehealth options was surprisingly low. About 40% of members were not aware of any telehealth services offered by their health plan and healthcare provider (hospital, doctor, nurse). Further, 40% of the respondents used telehealth services from a third party vs. their health plan’s offerings. Members across all health plans cited two major obstacles to using telehealth: an inability to see their existing physicians and having to pay the same co-pay for virtual care as for an in-person visit.<br> <b><br> Recommended actions<br> <br> </b>Improve member awareness of in-network telehealth options to help strengthen member relationships vs. giving third-party telehealth companies access to members. Payers can start by including their physician networks in telehealth options and adopting reimbursement models that offer incentives for members to use this lower-cost virtual care channel. Payers can also consider targeting Medicare and Medicaid members with telehealth options. Medicaid members reported a greater than 25% increase in adoption of telehealth, the highest among all business lines.</li> </ul>

<ul> <li><b>Payers can improve digital adoption rates among healthy members by providing wellness and health management offerings.</b> Among respondents, 23% said they have never interacted digitally with their health payer. Of those, 88% said they were in excellent or in good health while 52% were over age 50. As new healthcare competitors seek to interweave their products and services into consumers’ lives, most health payers typically only interact with members when they are enrolling, paying premiums or deciphering claims. Being competitive in the evolving healthcare industry requires payers to build closer relationships with all members. As the data indicates, members who are healthy tend to be digitally disengaged, yet it is imperative for payers to engage them when they are healthy rather than only when they are sick. The key to engaging healthy members is digitally powered wellness programs.<br> <br> </li> <li><b>Members also expect payers to play a larger role in their overall health and well-being and a plurality of members want to use health plan-provided apps to manage their wellness goals. </b>We expect mobility and wearables to make a significant impact in transitioning health payers to being health-and-wellness companies. More than 45% of members are willing to share information from their health tracking devices with their payers and trust them to protect the information.<br> <b><br> Recommended actions<br> <br> </b>Payers have an opportunity to craft a digitally powered engagement strategy that changes the member-payer relationship model from transaction-based to relational and drives real health benefits by addressing members’ wellness goals. Offering wellness features tied to wearables could create ongoing collaboration and engagement with healthy members, building on their willingness to share wearables data when incented and rewarded for doing so. Health plans must build consumer-grade tools and solutions to succeed here. These tools must deliver the intelligent personalization and seamless execution consumers have been accustomed to expect by digital powerhouses across a variety of industries.</li> </ul>

<p>Technology and retail enterprises now compete with payers to own the healthcare consumer. Payers must use their industry expertise and experience to build loyalty, retention and value across member lifetimes by addressing needs important to members. Our survey uncovered how members rank their digital needs. Payers should make immediate investments in features that members ranked high in importance and low in availability. Taking these actions will help payers build new value propositions on member relationships as regulations dismantle proprietary data and network silos. Successful payers will increasingly execute and innovate more like software and technology companies than traditional insurers.<br> </p>

<p>Jagan Ramachandran is an AVP & Partner in Cognizant’s Healthcare Advisory Practice. He leads with 20+ years experience at the intersection of healthcare business and technology, and he is an industry speaker on emerging healthcare trends.</p>

<p>William “Bill” Shea is a Vice President within Cognizant Consulting’s Healthcare Practice. He has over 20 years of experience in management consulting, practice development and project management in the health industry across the payer, purchaser and provider markets.</p>