The evolution of stores of value, from ancient cowrie shells to digital currencies, reflects humanity's enduring quest for a stable and reliable medium of exchange, writes Suhail Sabharwal, Senior Consultant, Banking & Financial Services Consulting, at Cognizant in UK & Ireland.

The world of finance is undergoing a profound transformation. As digital innovation reshapes the global economy, traditional notions of money and value storage are being challenged by the emergence of new, disruptive alternatives. Digital, non-monetary, and non-tangible stores of value are set to redefine the future of banking and finance.

Because their conception occurred outside of the realm of traditional banking and finance, these new stores play a crucial role in the democratisation and decentralisation of finance.

Moreover, the idea of "everywhere, anything of value" is gaining traction as the world moves towards a future where any asset, whether tangible or intangible, can be tokenised and traded as a new store of value, further blurring the lines between traditional finance and the digital economy.

Evolving stores of value

The concept of a store of value can be traced back to the dawn of human civilisation, with the Mesopotamian Shekel, thought to be the first form of currency. As societies evolved and trade flourished, the need for a reliable and universally accepted medium of exchange became increasingly apparent.

From the earliest forms of currency, such as cowrie shells and beads, to the adoption of precious metals like gold and silver, humans have sought a stable and enduring store of value. These early forms of money served not only as a means of facilitating trade but also as a way to preserve wealth over time. As civilisations grew more complex and interconnected, money evolved, taking on various forms such as coins, paper currency, and, eventually, digital representations of value.

The rise of digital currencies

Bitcoin, the first decentralised cryptocurrency, emerged in 2009 as a revolutionary new store of value. Developed by an anonymous individual or group known as Satoshi Nakamoto, Bitcoin leveraged the power of blockchain technology to create a secure, transparent, and immutable ledger of transactions. By eliminating the need for intermediaries such as banks and governments, Bitcoin offered a new paradigm for financial transactions that prioritised privacy, security, and individual sovereignty.

As Bitcoin gained traction, it sparked a wave of innovation in the world of digital currencies, paving the way for the emergence of countless other cryptocurrencies and blockchain-based projects.

Challenges like regulatory scrutiny and market volatility have allowed alternatives like stablecoins and Central Bank Digital Currencies (CBDCs) to emerge. Stablecoins combine the stability of traditional currencies with the benefits of blockchain technology, while CBDCs provide central banks with better control over monetary policy and regulatory oversight.

Beyond digital currencies, other innovative stores of value are emerging. Non-monetary stores like carbon credits, representing a reduction in carbon dioxide emissions, are gaining traction as sustainable assets. Non-tangible stores like time, influence, data ownership, and privacy rights are also becoming increasingly valuable in the digital age. As societal values and technologies evolve, these alternative stores of value may play a significant role in shaping the future financial landscape.

Twin advantage of speed and trust

Digital currencies’ decentralised nature offers numerous advantages, such as fast borderless transactions with low fees and quick settlement times, making them an attractive option for international payments and remittances.

The growing adoption of these new value stores is beyond just retail consumers. Institutional investors, including hedge funds, pension funds, and family offices, increasingly allocate portions of their portfolios to digital assets. This institutional interest is driven by the potential for high returns, diversification benefits, and the desire to stay ahead of the curve in a rapidly evolving financial landscape.

Further, the rise of decentralised finance (DeFi) platforms has opened up new avenues for financial services, such as lending, borrowing, and trading, without traditional intermediaries. These platforms, built on blockchain technology, offer greater transparency, accessibility, and potential for innovation, further challenging the role of conventional banking institutions.

Emerging concepts such as the Regulated Liability Network (RLN) provide a framework for integrating Distributed Ledger Technology (DLT)-based currencies with existing payment rails and market infrastructure. This ensures not only regulatory compliance but also interoperability with other digital assets, faster settlement, increased collaboration, and enhanced transparency, potentially promoting an even broader future adoption of new value stores.

Digital natives lead the way

Millennials and Gen Z, the digital natives at the forefront of this financial revolution, are driving the adoption of new value stores. Studies reveal that between 62% and 94% of these demographics hold or own cryptocurrency, reflecting their comfort with digital transactions and affinity with innovative financial solutions.

As the global digital currency market capitalisation surpassed $1.7 trillion in 2023, with a projected CAGR of 12.5% by 2030, it's clear that these new value stores are here to stay. Banks must recognise the shifting preferences of their future customers and adapt their strategies accordingly.

Should banks be worried?

The emergence of new value stores presents a formidable challenge to traditional banking models. As digital currencies, non-monetary stores, and non-tangible stores gain prominence, banks risk being left behind if they fail to innovate and adapt.

Banks must acknowledge the possibility of a future where:

1) Digital currencies begin to co-exist with and challenge the dominance of fiat money in global economic activity

2) Traditional business models undergo a drastic transformation, rendering legacy banking services unprofitable

3) Non-banking tech giants and emerging economies pose an increasing threat by leapfrogging others in digital currency adoption

In times of rapidly shifting technological paradigms, incumbents must act swiftly in response to evolving technology and consumer demands to remain ahead of the game.

How banks can keep pace

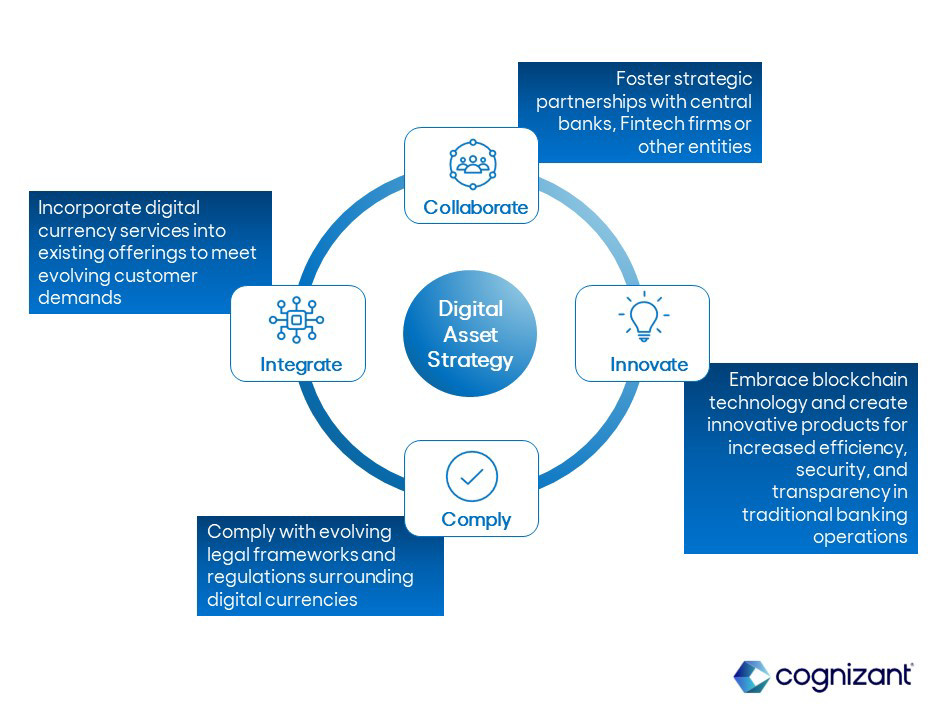

To remain competitive, banks must adopt a comprehensive digital asset strategy underpinned by four key pillars: Innovate, Collaborate, Integrate, and Comply.