How RegTech optimizes compliance for banks (Part 1) styles-h2 text-white

data-xy-axis-lg:null; data-xy-axis-md:null; data-xy-axis-sm:70% 40%

<p><span class="medium"><br>April 13, 2022</span></p>

How RegTech optimizes compliance for banks (Part 1)

<p><b>Digital technologies offer a ray of hope for banks and regulators looking to optimize compliance processes.</b></p>

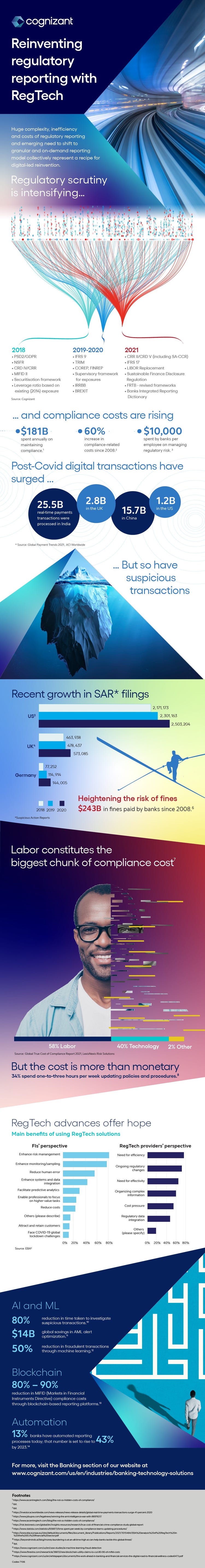

<p>The regulatory reporting landscape has been in a state of flux since 2008. While regulators were adding new rules to meet emerging needs, banks have been trying to simplify regulatory reporting processes, with minimal results. However, the impetus to digitize after the COVID-19 pandemic has upended plans and forced a re-evaluation of the regulatory reporting agenda.</p> <p>Since digital regulatory transactions lead to more reportable data and generate more granular data — something regulators demand — the time is ripe for financial institutions (FIs) and regulatory agencies to embrace technologies that enhance regulatory reporting, including artificial intelligence (AI), machine learning (ML), advanced analytics and blockchain — in the form of distributed ledgers.</p> <h4>Four steps to improve regulatory reporting compliance</h4> <p>As RegTech reshapes the reporting landscape, we believe the following factors are critical for FIs looking to optimize compliance:</p> <ul> <li><b>Work to create a single data repository</b> using big data (i.e., an architecture for a staging layer for trade/posting/product-specific information and a managed data layer that contains product-agnostic and flattened/harmonized data) that merges all bits and bytes data currently used for reporting across geographies and businesses, creating a single source of truth and lower cost of ownership.<br> <br> </li> <li><b>Use AI and ML </b>to improve product control adjustments and reconciliation of data (via a data mart with general ledger/golden source). This helps to cut dependence on manual processes at the initial stages, reducing mismatches and lowering costs.<br> <br> </li> <li><b>Ensure a consistent taxonomy</b> across the board (i.e., within a financial institution as well as a regulatory-driven taxonomy for a given geography) to enhance data quality and minimize breaks.<br> <br> </li> <li><b>Embrace distributed ledger technology </b>to deliver regulators’ requirement for on-demand reporting capability — particularly in trade and transaction reporting.</li> </ul>

#

<p><br> <a href="https://www.cognizant.com/us/en/insights/perspectives/how-regtech-optimizes-compliance-for-banks-part-2" target="_blank">Part 2</a> of this series will look at ways to embrace RegTech to transform the financial services regulatory reporting landscape.</p> <p><i>This infographic was created by Vinod Malpani, Suprotim Dutta and Gaurav Mundra, Senior Director, Consultant and Senior Manager respectively with Cognizant’s Banking and Financial Services Consulting Practice.</i><br> </p> <p><i>For more, visit the <a href="https://www.cognizant.com/us/en/industries/banking-technology-solutions" target="_blank" rel="noopener noreferrer">Banking section</a> of our website or <a href="/content/cognizant-dot-com/us/en/about-cognizant/contact-us.html" target="_blank" rel="noopener noreferrer">contact us</a>.</i></p>

<p>We’re here to offer you practical and unique solutions to today’s most pressing technology challenges. Across industries and markets, get inspired today for success tomorrow.</p>