Future-ready media: Data and entertainment supply chain strategy

<p><span class="medium"><br>September 15, 2022</span></p>

Future-ready media: Data and entertainment supply chain strategy

<p><b>While M&E businesses often lead in adopting new technologies for user experiences, Economist Impact research supported by Cognizant suggests they now need to operationalize data and technology, and a well-defined entertainment supply chain strategy to drive future growth.</b></p>

<p>The media & entertainment industry is in the midst of prolific change. An industry that only a decade ago was rooted in cable, broadcast and physical-world mechanisms has quickly become internet protocol (IP)-centric, with streaming now overtaking cable TV viewership. And with cloud, 5G and edge technologies playing a greater role in evolving media business strategies, it is clear to see the path forward is IP-dominant.</p> <p>The advertising industry saw a similar shift from traditional forms to digital. Digital was a sliver of overall advertising in 2010. Today, it captures nearly seven out of 10 ad dollars. <a href="https://digiday.com/marketing/the-rundown-google-meta-and-amazon-are-on-track-to-absorb-more-than-50-of-all-ad-money-in-2022/" target="_blank" rel="noopener noreferrer">According to Digiday</a>, Google, Meta and Amazon account for 74% of global digital ad spend—highlighting the importance of mining data into insights and, in turn, refining insights into network effects that offer strategic advantages across infrastructure, operations and products, including a robust entertainment supply chain strategy to meet shifting demands.</p> <p>As in digital advertising, it is likely that a handful of global content players will succeed in redefining the mission of the media company from financier and distributor, into personal experience optimizer. And like the giants that have subsumed most of the profits, these big winners are likely to become cloud-native platform businesses to achieve radical efficiencies around this pursuit. </p> <h5>A data-dependent tomorrow<br> </h5> <p>With change being the only constant, what works today may be radically different tomorrow in a never-ending race to experiment, learn and adapt to audiences. For example, the traditional cable bundle has largely unwound, but similar dynamics that led to its birth may give rise to super aggregators that bundle streaming subscriptions. Understanding consumers and how they share attributes is essential to understanding behaviors and fine-tuning content strategies, operations and business models.<br> </p> <p>As media companies strive to acquire customers, then maintain them, then earn profits from them, some must also navigate adjacent opportunities like entry into new business models and mediums, like ad-supported models, the metaverse, video gaming and gambling.<br> </p> <p>With deprecation of third-party cookies nearing, the ability to target and prove measurable campaign-level performance requires media companies to collect and leverage their own first-party data, while entering into partnerships with brands, agencies and technology partners to compete for scale.<br> </p> <p>Understanding and exploiting rights across geographies and distribution paths is essential to managing costs while maximizing revenue potential. Media companies must develop a robust entertainment supply chain strategy and become increasingly proficient at using data to model the tradeoffs associated with complex decisions, like whether to acquire rights at a loss to further strategic interests, and whether to challenge traditional theatrical windowing.<br> </p> <h5>A digital path forward</h5> <p>The issue will be getting from here to there. The content experience industry is undergoing massive consolidation. Leaders are seeking to optimize distribution methods in order to maintain relevance with a fickle, demanding customer base—and are doing so while managing shifting economics. In addition to fresh content, consumers want value-based pricing, ease in content discovery, convenient administrative activities and services that learn.</p> <p>To keep up, media & entertainment executives must connect technology directly to strategic functions. At the top, this requires deep alignment between the CIO and CTO to break down siloes, align technology capabilities to business outcomes and transform tech debt into tech wealth.</p> <p>For example, the present day media supply chain is commonly seen as a technology function to transform and distribute media. In the evolving landscape, its purpose will be to serve the business, by converging insights about the real-time context of user engagement, a full understanding of the content itself at each stage of its lifecycle (including related rights) and a single 360-degree view of audiences. A robust entertainment supply chain strategy transforms the media supply chain from being about fulfilling work orders, to becoming the beating heart for dynamic engagement.</p> <p>Make no mistake, though: The sector has a great deal going for it, such as its commitment to technology adoption, its ability to extract strategic value from tech investments and its competency with data. Recent Economist Impact research supported by Cognizant illustrates key organizational challenges the industry faces as companies make the move toward future readiness.</p> <h4>Four big technology bets have captured the M&E industry</h4> <p><i>Respondents were asked which technologies and methodologies their business has adopted or is planning to adopt in the next two years. (Percent of respondents who have adopted or plan to adopt)</i><br> </p>

#

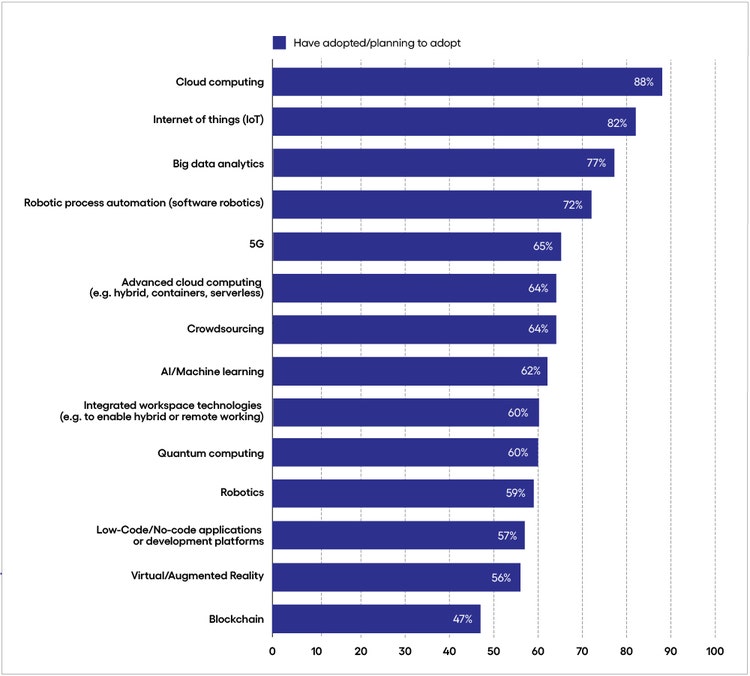

<p><span class="small">Response base: 250 senior media & entertainment executives<br> Source: Economist Impact Survey 2022<br> Fig 1</span></p> <h5>What they're good at </h5> <ul> <li><b>Adopting core technologies.</b> This is a fundamental strength for the industry as leaders look to achieve internet scale for their business. It’s impressive, while not surprising, that M&E companies are embracing virtual and augmented reality (VR/AR), as well as 5G, in such significant numbers—the better to deliver those future experiences.<br> <br> Additionally, industry executives report adoption of four main technologies: cloud (88%), Internet of Things (82%), big data analytics (77%) and robotic process automation (72%). Each of these technologies pulls double duty by enabling streamlined operations across the business and improved delivery speed, quality and relevance to consumers.</li> </ul> <h5>Long way to go<br> </h5> <ul> <li><b>Integration is a challenge.</b> The other side of the industry’s appetite for new technologies is resolving existing technical debt and integrating legacy systems with new components. Tech adoption itself is not a strategy; without the ability to link technology to strategic functions, senior leaders struggle to expand, fund and complete their initiatives.<br> <br> Further complicating the industry’s circumstances is the lack of a formal business reference architecture defining customer value streams and how the organization and technology functions must realign to serve their strategic goals. In an overactive acquisition environment, this lack can prove fatal.</li> </ul> <h5>The importance of bridging the gap<br> </h5> <ul> <li><b>Business model innovation requires that technology be operationalized.</b> Building new revenue streams and designing new business models will prove vital as the M&E industry continues to mature. This has been underscored in recent quarters with Netflix, once seemingly invincible, now shedding subscribers, partnering to launch ad-supported services and exploring diversification into gaming.<br> <br> No player can rest on its laurels or its content—it will also be essential to align with audiences, experiment constantly, personalize content and experiences, and adapt business models, all supported by data.<br> <br> Technology also has a major role to play in creating a user experience that engages all the senses. The user experience will need to feel as intense and as real as possible. Moreover, all this must be streamed to virtually any device. Sony’s Personal 3D Viewer headset and Meta’s AR glasses are just two harbingers of the future for which the sector must prepare.</li> </ul> <h4>A steady focus on the future returns positive impact</h4> <p><i>Respondents were asked to what extent the following technologies and methodologies are delivering strategic value to their operations. (Percentage of respondents saying significant value)</i></p>

#

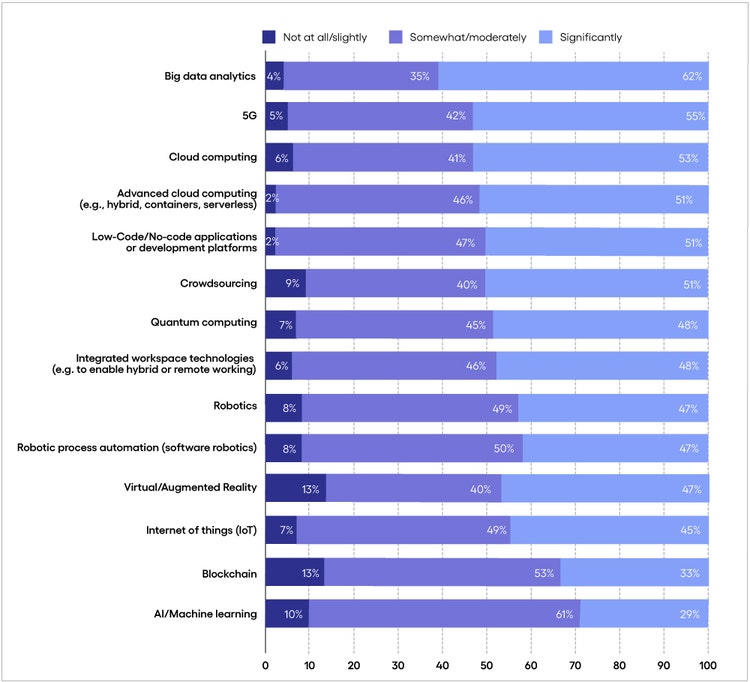

<p><span class="small">Response base: 250 senior media & entertainment executives<br> Source: Economist Impact Survey 2022<br> Fig 2</span></p> <h5>What they're good at </h5> <ul> <li><b>Practice makes perfect.</b> A solid majority (62%) of media & entertainment executives report gaining significant strategic value from big data analytics. This supports the idea that data informs production.<br> <br> Again we turn to Netflix as an example, this time in a positive sense; the streaming giant has used predictive models for a decade. By analyzing not only which shows and movies viewers watch but also when they pause or repeat, the company has created an enviable database on each of its more than 200 million subscribers.<br> <br> Another example of the power of predictive algorithms comes from TikTok, which digs through vast amounts of data to ensure audiences get the content they are most likely to enjoy and engage with.<br> <br> While data analytics is the area in which leaders feel most confident about delivering strategic value, the data suggests that all technologies are contributing to enhanced operations. This is likely due to the fact that sector players were early adopters. For example, the industry has a track record of inventing, transforming and industrializing some of the best cloud capabilities available on the market.</li> </ul> <h5>Long way to go<br> </h5> <ul> <li><b>Cost and efficiency, balanced well with strategic objectives,</b> is a longtime mantra of the M&E industry. This is demonstrated in the data, with 71% of leaders reporting low return on value from artificial intelligence and machine learning.<br> <br> What makes this data point interesting is that machine learning is putting big data to work in new ways—and the industry is an enormous data generator. With imminent changes coming in access to third-party data, M&E executives may have to reevaluate data programs, from collection and organization through to security and ethics. Domain-specific applications delivered with continuous learning and innovation is the sweet spot for leaders in the industry.</li> </ul> <h5>The importance of bridging the gap<br> </h5> <ul> <li><b>Early adoption is no longer the goal; precision implementation and optimization are.</b> As illustrated in recent years by the initial fanfare, then quick shuttering, of Quibi and CNN+, the industry has witnessed new entrants that intend to disrupt existing consumption behaviors only to have subscribers wane quickly.<br> <br> Future-proofing an organization in M&E will rest on how well existing technology is optimized, how well new technology is integrated with legacy systems, and how well emerging technology is leveraged for the customer experience. This means companies need to be agile and reflexive enough to innovate, take risks, experiment, fail and adapt services constantly. The key to these activities is good, responsible data practices.</li> </ul> <h4>Organizational dynamics lead to operational limitations</h4> <p><i>Respondents were asked to identify the most significant challenges their business faced when implementing new processes, services and technologies in the past year. Select up to five. (Percent of respondents selecting each challenge.)</i></p>

#

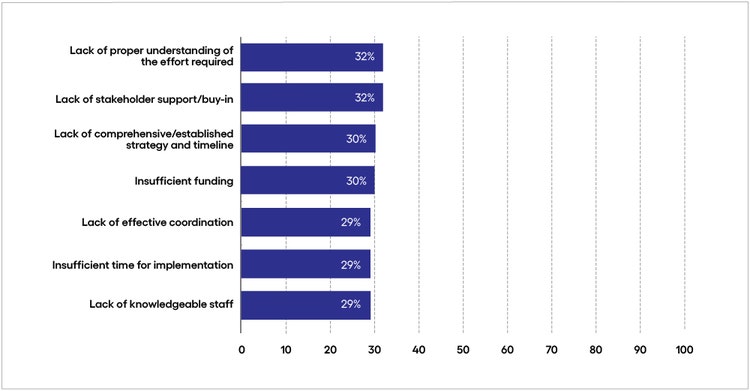

<p><span class="small">Response base: 250 senior media & entertainment executives<br> Source: Economist Impact Survey 2022<br> Fig 3</span></p> <h5>What they're good at </h5> <ul> <li><b>Having a clear objective in delivering meaningful experiences to customers</b> through a targeted distribution strategy is something that sets the media & entertainment industry apart. With this single focus, leaders can set a direction for teams to work toward with some autonomy. This results in increased creativity and innovation throughout the business, which may lead departments to major wins in a complex environment. </li> </ul> <h5>Long way to go<br> </h5> <ul> <li><b>Organizational and operational limitations </b>plague the industry.<b> </b>The most significant challenges around implementing new processes, products, services and technologies reported by leaders were lack of proper understanding of the effort required (32%), lack of stakeholder support or buy-in (32%), insufficient funding (30%), lack of comprehensive or established strategy and timeline (30%) and lack of effective coordination (29%). This may indicate a lack of leadership, standards and governance when it comes to developing and evaluating business cases and running projects.<br> <br> On the other hand, it may be illustrative of an industry undergoing massive structural change as data bleeds into every aspect of the business, creating organizational and operational paralysis in its wake.</li> </ul> <h5>The importance of bridging the gap<br> </h5> <ul> <li><b>If you want to go far, go together.</b> In examining industry leaders’ responses to the survey, we do not come away with a sufficient sense of urgency. Tech is causing an earthquake in the sector, and executives may not be keeping pace.<br> <br> Media & entertainment companies are maintaining a delicate balance between production economics, delivery preferences and increased competition for limited time and attention. Leaders have an opportunity to tighten up their organizations, remind team members of the mission and optimize operations to deliver on that mission. For this industry, the only way forward is through collaboration, internally and externally.</li> </ul> <p><i>To learn more, visit the <a href="/content/cognizant-dot-com/us/en/insights/modern-business.html" target="_blank" rel="noopener noreferrer">Modern Business</a> section of our website or <a href="/content/cognizant-dot-com/us/en/about-cognizant/contact-us.html" target="_blank" rel="noopener noreferrer">contact us</a>.</i></p> <p><i>The views and opinions expressed in this report are those of Cognizant and do not necessarily reflect the view and policies of Economist Impact. Data presented is from an Economist Impact executive survey, commissioned by Cognizant, conducted in early 2022.<br> <br> This article was written by Laurie Hutto-Hill, VP of Consulting and Chad Andrews, AVP & Consulting Partner, in Cognizant’s Communications, Media & Technology practice.</i></p>

<p>We’re here to offer you practical and unique solutions to today’s most pressing technology challenges. Across industries and markets, get inspired today for success tomorrow.</p>