We have the solutions you need to extend the functionality of your core system, fully integrated and immediately effective.

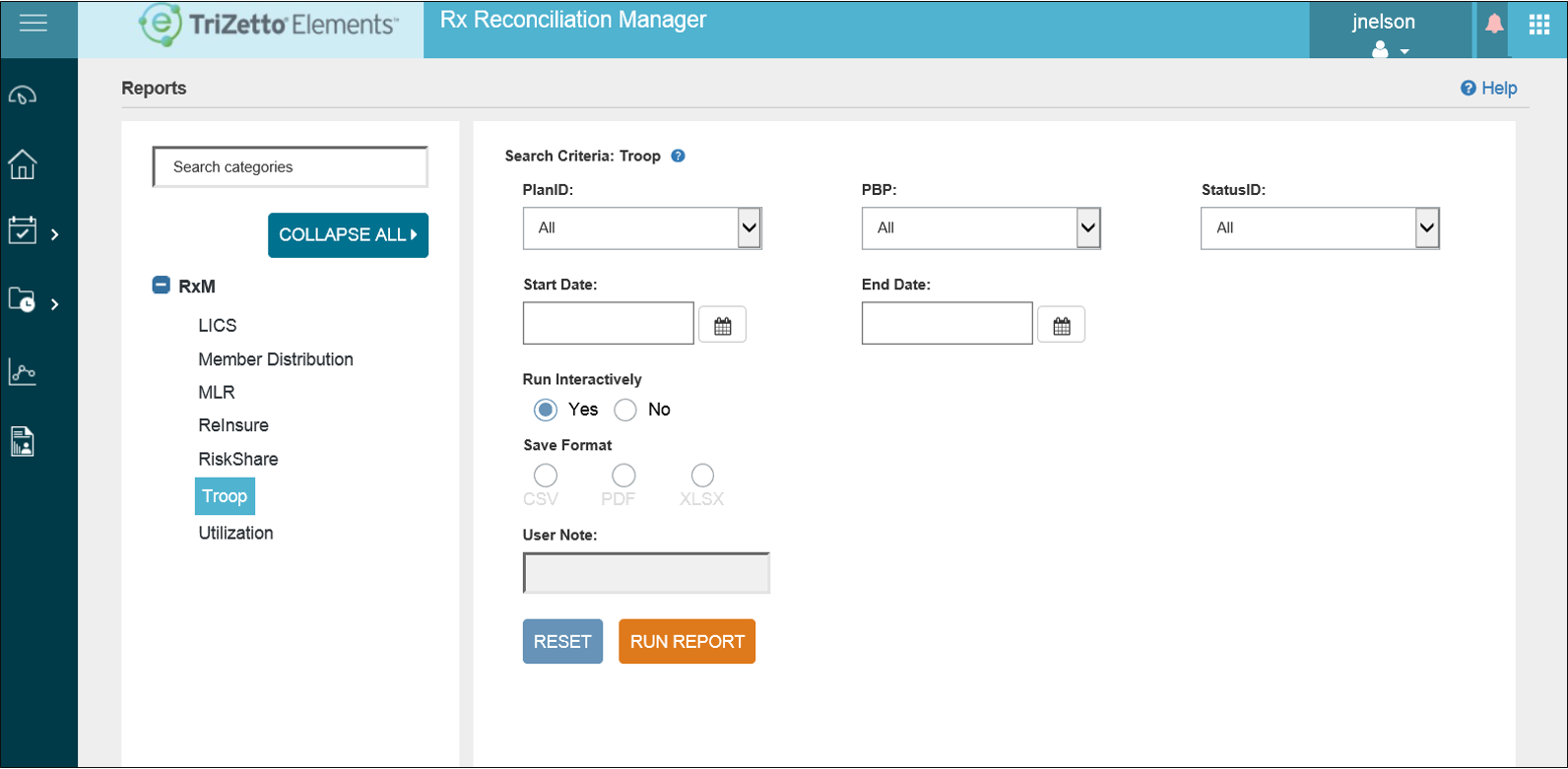

Meeting the complex data processing and compliance requirements of Medicare Advantage, managed Medicaid and Commercial Exchanges in a timely manner is critical to your success. Our TriZetto Elements® suite extends the functionality of your core system with the features you need. By providing critical capabilities for tasks ranging from enrollment through risk adjustment, Elements helps you efficiently drive these lines of business forward.

Our standalone solutions, including Facets®, QNXT™ and other core systems, integrate well together. The Elements products make it easy to share information and speed processing.

With Elements you can:

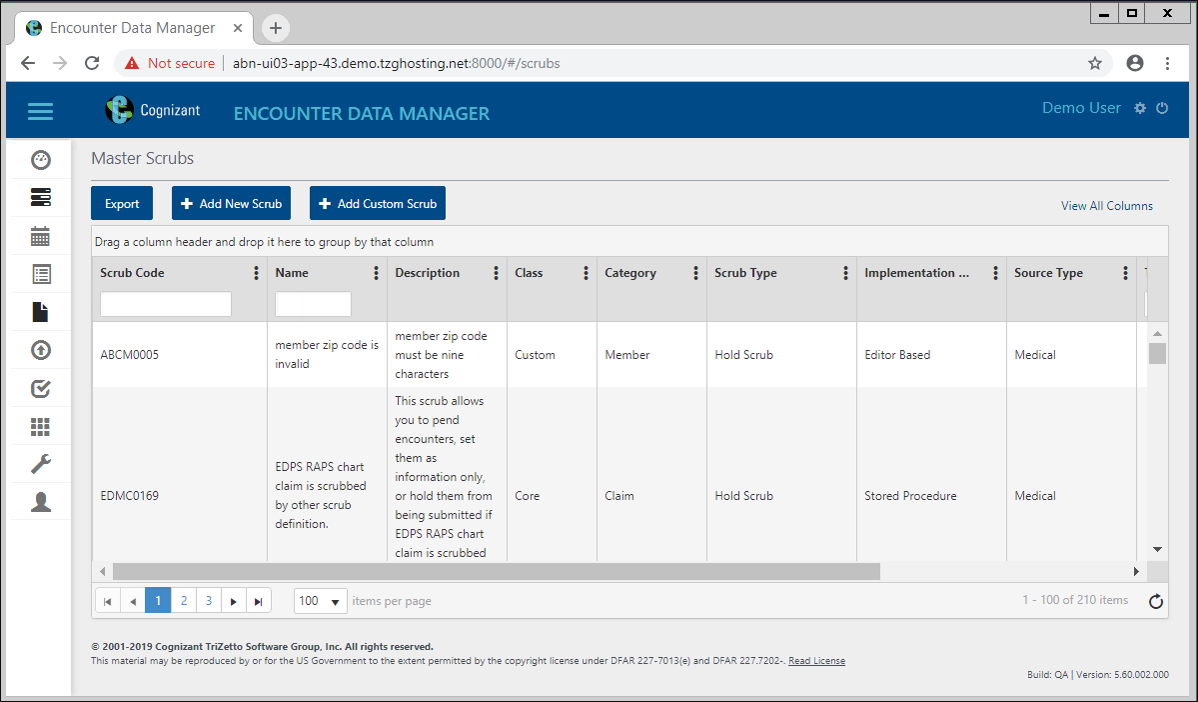

- Track and transform encounter data.

- Automate encounter, Risk Adjustment Processing System (RAPS) and risk adjustment data submission.

- Facilitate interactions between your plan and Centers for Medicare and Medicaid Services (CMS).

- Maximize reimbursements.

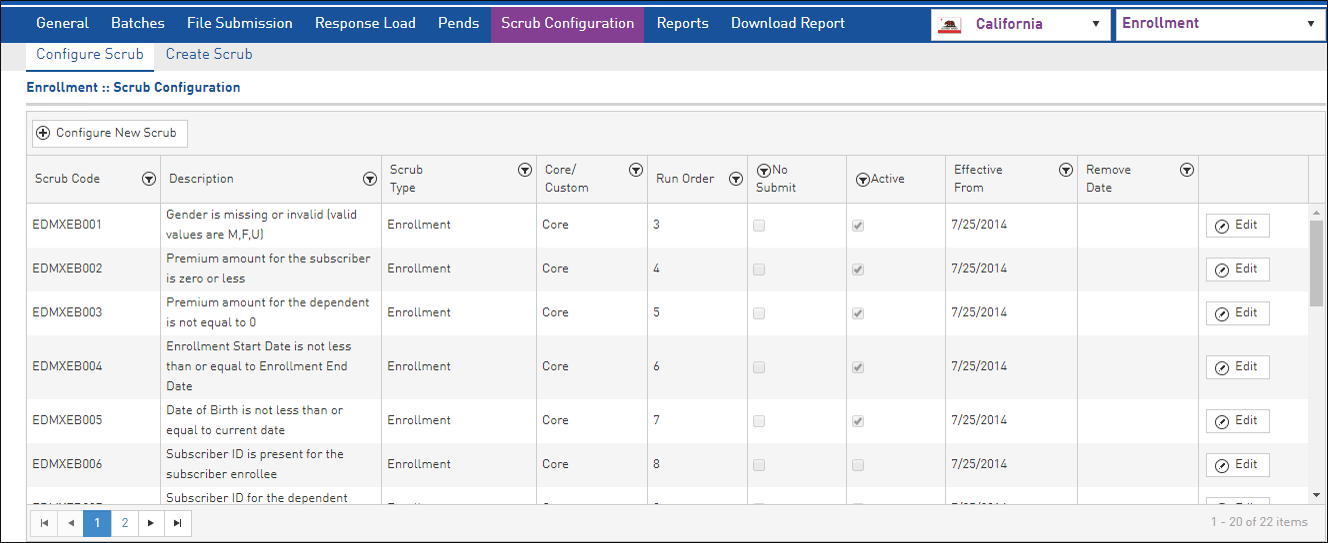

- Accelerate response to regulatory changes.

- Improve acceptance rates.

- Reduce the risk of potential CMS penalties.

BEQ: The Batch Eligibility Query file includes transactions submitted by plans requesting eligibility information for prospective plan enrollees. Plans use BEQ files to conduct initial eligibility checks against the Centers for Medicare and Medicaid Services (CMS) Medicare Advantage Prescription Drug (MARx) database system to verify members Part A/B eligibility.

TRR: The Transaction Reply Report is a daily electronic CMS file that includes member information and updates. The files also include Transaction Reply Codes (TRCs) to explain the system’s actions in response to new information from CMS or input from managed care organizations (MCOs), CMS or other vendors.

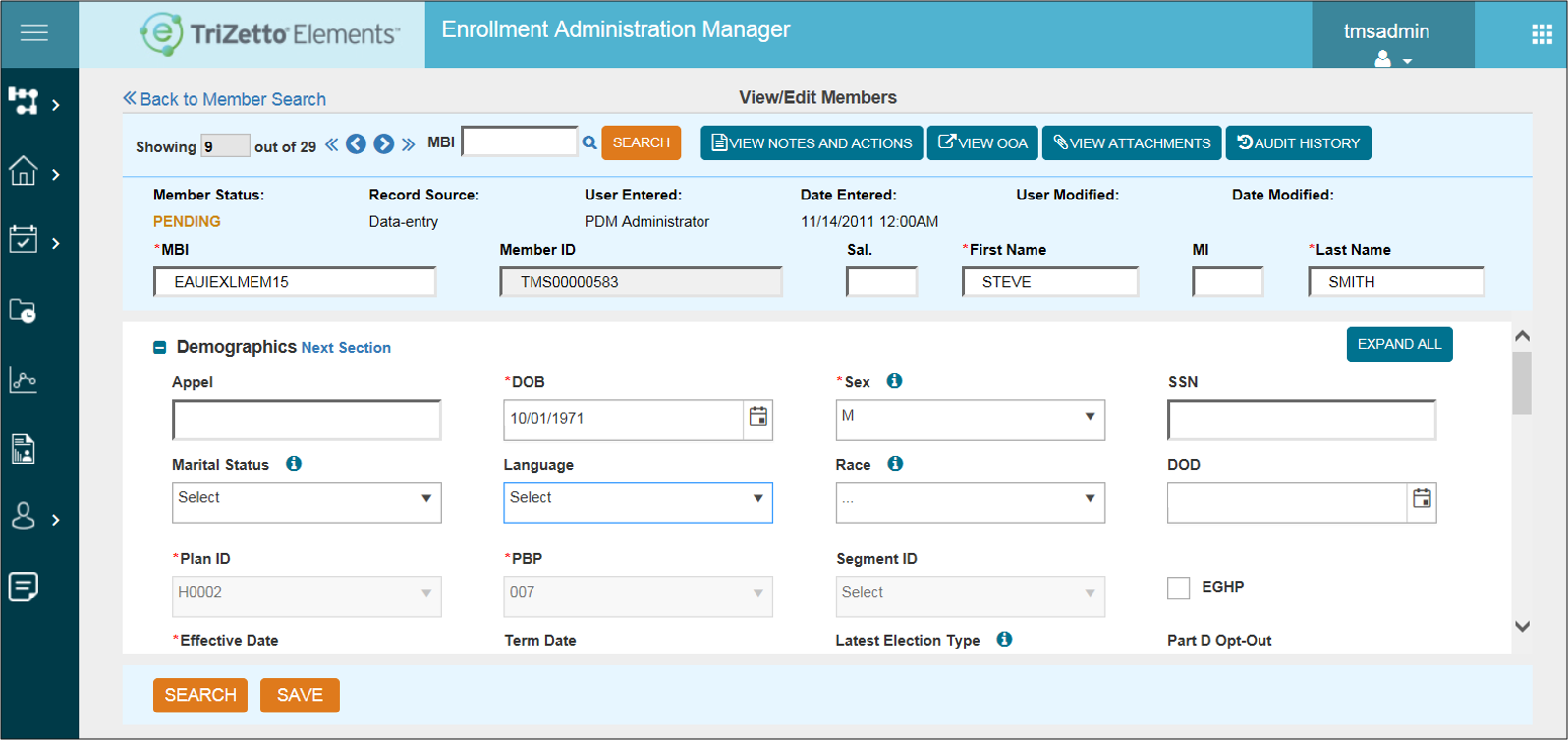

OEC: Online Enrollment Centers submit Medicare membership information electronically. An Enrollment Administration Manager accepts these electronic enrollment files and automatically updates the membership.

LEP: Late Enrollment Penalty information is included in the daily CMS TRR files. Correct LEP information is attached to the member’s record and incorporated in the member’s premium billing statement.

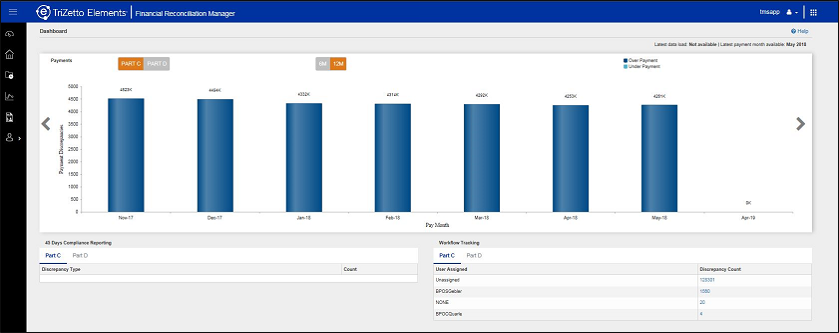

MMR: The Monthly Membership Report is the electronic payment file from CMS. It is loaded automatically to help plans easily identify payment discrepancies and prioritize research for resolution.

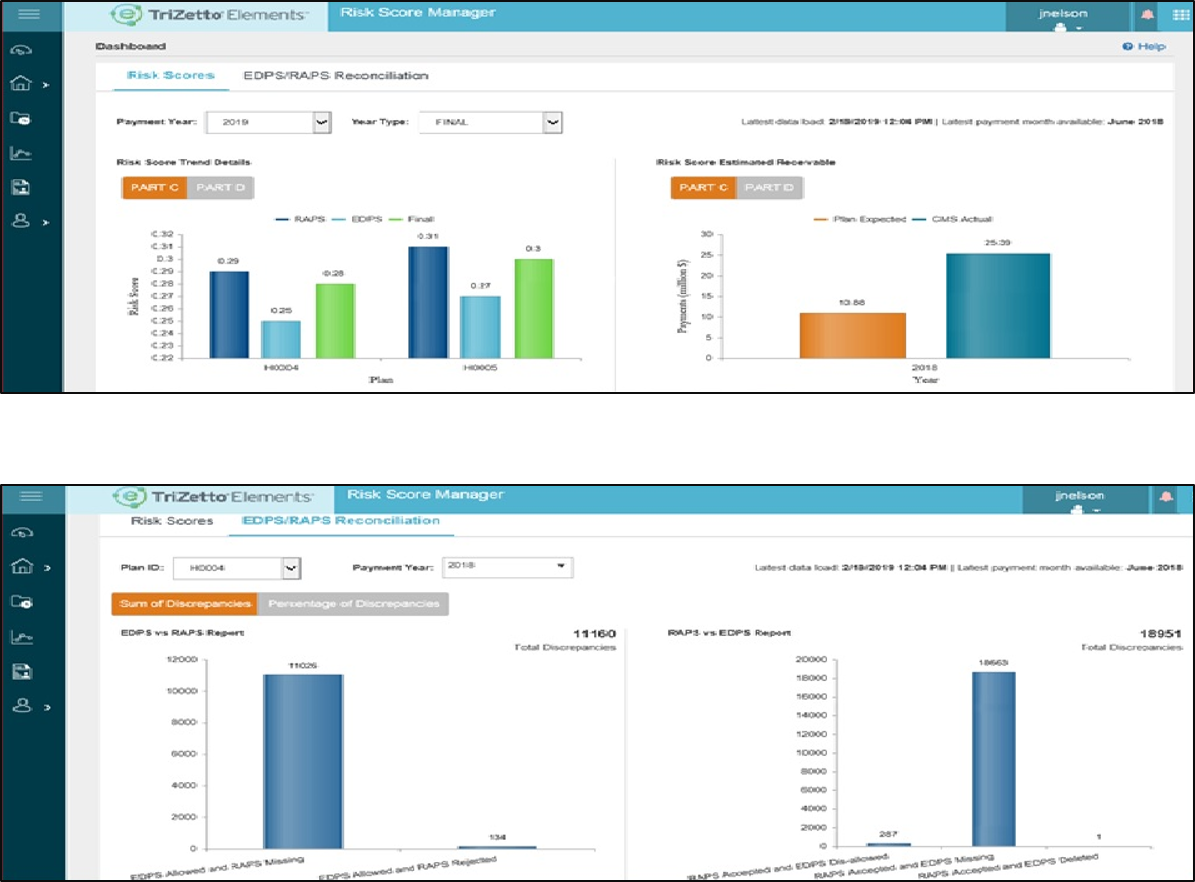

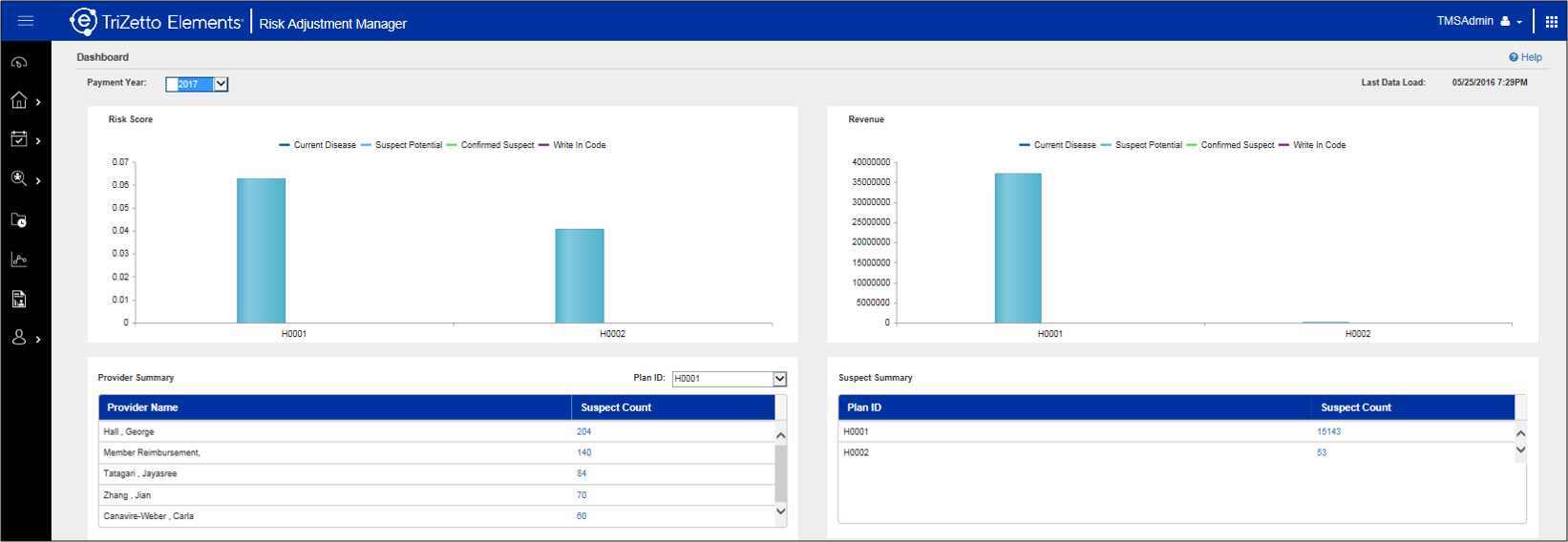

HCC: CMS uses a Hierarchical Condition Categories model to adjust capitation payments to health plans for the health expenditure risk of their enrollees. The CMS Risk Adjustment Model measures the disease burden using diagnosis codes associated with more than 70 HCC categories. The CMS model is cumulative, meaning that over time patients can have more than one HCC category assigned to them. Some categories override others within the category hierarchy.

HCC MOR: The HCC Model Output Report file contains a series of flags indicating which demographic factors (age, sex and entitlements for Medicaid and disability) and disease factors (HCCs and disease interactions) are used to calculate the risk score for each beneficiary enrolled in the plan. Plans receive separate MOR files for Part C (CMS-HCC) and Part D (RxHCC) risk adjustment models.

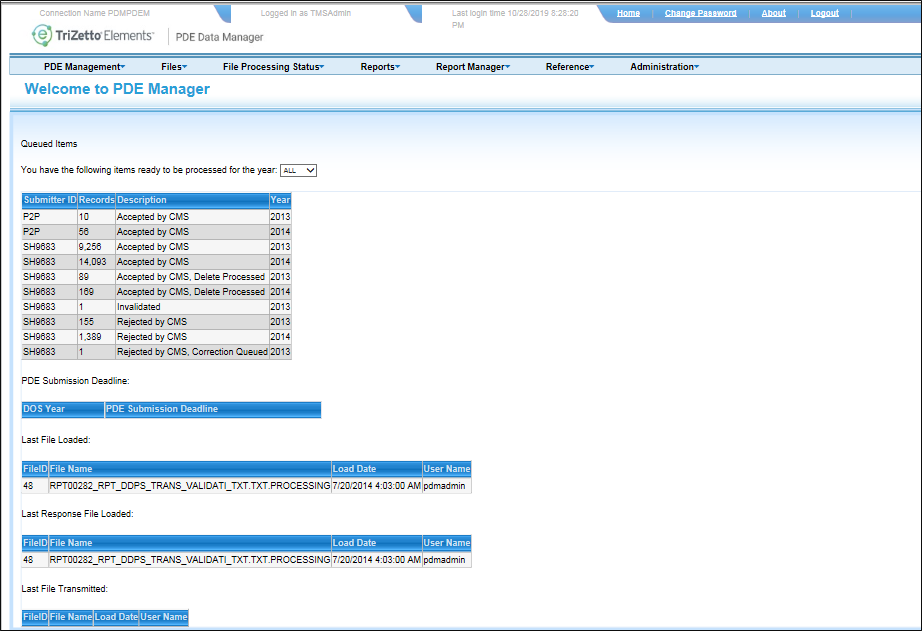

Risk Adjustment: CMS uses risk adjustment to pay plans based on the risk of the beneficiaries they enroll, instead of using an average amount for all Medicare beneficiaries. By risk adjusting plan payments, CMS makes appropriate and accurate payments for enrollees with different cost expectations. Bids and payments are made based on the health status and demographic characteristics of an enrollee. Risk scores measure an individual beneficiary’s relative risk and are used to adjust payments for each beneficiary’s expected expenditures. By risk adjusting plan bids, CMS is able to use standardized bids as base payments to plans. Claims data is sent to CMS via:

- RAPS: Risk Adjustment Processing System

- EDPS: Encounter Data Processing System

- DDPS: Drug Data Processing System

TriZetto elements